WooCommerce payment plugins play a key role in helping your online store accept and process online transactions securely, quickly, and efficiently. Without them, your customers won’t be able to complete their orders.

Choosing the right plugin will not only help you process payments, but also ensure customer data security, provide a variety of payment methods, and be compatible with the currencies and regions your store serves. From credit cards, e-wallets to local payment methods, the right plugin will increase reliability and improve payment success rates.

In this article, Hidemium will introduce the most popular WooCommerce payment plugins today, and share important criteria to help you choose the optimal solution for your store.

1. Why is choosing the right WooCommerce payment plugin important?

Choosing the right plugin directly affects your sales, customer experience, and store performance. An under-optimized plugin can lead to high transaction fees, slow processes, or poor security. Here are some important reasons:

Security & Fraud Prevention: Protect customer data through encryption, tokenization, and advanced verification layers.

Payment experience: Helps shorten transaction completion times, reduce cart abandonment rates, and increase satisfaction.

Expanding global market: Supports multiple currencies and local payment methods, facilitating access to international customers.

Compliance: Ensure compliance with industry standards such as PCI DSS.

Cost & Payment Schedule: Directly affects cash flow through processing fees, time to receive funds and additional charges.

Before you decide, consider your store size, target audience, and payment habits. The right plugin will not only ensure smooth, secure transactions, but will also help build trust and drive long-term revenue.

>>> Learn more: The Most Potential Dropshipping Products to Sell in 2025

2. Compare WooCommerce Payment Plugins by Fees, Regions & Features

Before going into the detailed review, let's refer to the comparison table of the most popular WooCommerce payment plugin today. This table summarizes important factors such as transaction fees, support areas and outstanding features, helping you easily choose the right solution for your business model.

Payment Plugin | Transaction Fee* | Support Area | Outstanding features |

| WooCommerce Payments | 2.9% + $0.30/transaction | US, UK, EU, Australia and many other countries | Direct WooCommerce integration, uses Stripe, supports Apple Pay & Google Pay |

| Stripe | 2.9% + $0.30/transaction | More than 40 countries | Multi-currency payments, subscription support, advanced fraud protection |

| PayPal Standard | 2.9% + flat fee per currency | Global | Trusted brand, quick installation, buyer protection program |

| Mollie | Depends on method (iDEAL: €0.29) | EU, UK | Various European payment methods, support recurring payments |

| Paystack | 1,5% + ₦100 (Nigeria) | Africa | Local currency support, fast money transfer, mobile interface optimization |

| Razorpay | 2%/transaction | India | Supports UPI, EMI, recurring and 100+ other methods |

💡 Note: Transaction fees may vary by country, payment type, or service plan. Always check the official price list from the provider for the most up-to-date information.

👉 With the comparison table above, you can quickly identify which plugin best meets the needs of your WooCommerce store, from global support, reasonable cost, to customer experience optimization features.

3. Detailed review of each WooCommerce plugin (Advantages, limitations & use cases)

When choosing a payment plugin for WooCommerce, carefully analyzing the pros and cons of each tool is an important step to help you make the right decision. Below is a detailed review of popular plugins, along with suggestions for appropriate use cases.

3.1. WooCommerce Payments (Original solution)

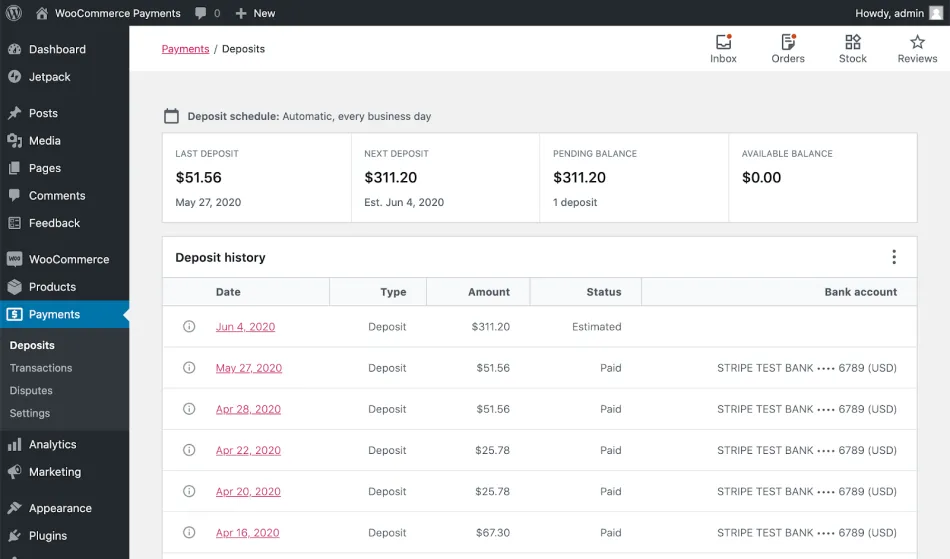

WooCommerce Payments is the official payment plugin developed and maintained by the WooCommerce team. Based on Stripe, it integrates seamlessly into your WordPress dashboard, allowing you to manage the entire payment process, refunds, and transaction tracking right on your website.

Outstanding advantages:

Direct integration: Works right on WooCommerce without needing to install additional plugins.

Centralized control panel: Manage orders, payments and refunds in a single interface.

Various payment methods: Supports international cards, Apple Pay, Google Pay and many domestic forms.

Multi-currency support: Display and receive payments in the currency that suits your customers.

Limit:

Area limits: Not available in all countries.

Stripe Dependencies: Some features may overlap if you are already using a separate Stripe account.

👉 With this feature, WooCommerce Payments especially suitable for stores located in supported regions, who want to quickly deploy and manage all payments directly on WooCommerce without complicated configuration.

3.2. Stripe Gateway Plugin

Stripe Gateway is one of the most popular WooCommerce payment plugins, highly regarded for its global scalability and flexibility across multiple transaction types. It supports payments by credit cards, debit cards, e-wallets (Apple Pay, Google Pay), and multiple local methods, all processed on a highly secure platform.

Outstanding advantages:

Global Support: Operating in over 40 countries, supporting multi-currency transactions.

Various payment methods: Including cards, e-wallets and domestic payments.

Support recurring payments: Suitable for membership websites or long term subscription services.

Strong Security: Integrated Stripe Radar for anti-fraud, PCI compliance.

Disadvantages:

Account Verification Required: Stripe authentication can be difficult for some merchants.

Delivery time varies by region: In some countries, payments may take several days to be credited to your account.

👉 With these advantages, Stripe Gateway is the ideal choice for businesses targeting international markets, supporting both one-time payments and recurring needs, while providing a high level of security and a seamless payment experience for customers.

3.3. PayPal Gateway

PayPal is one of the most popular online payment brands in the world. When integrated with WooCommerce, customers can easily pay with PayPal balance, linked bank account, credit card or debit card. In particular, the program Buyer Protection PayPal's (buyer protection) provides peace of mind for customers, especially first-time shoppers.

Outstanding advantages of PayPal Gateway:

Global Recognition: Trusted by millions worldwide, contributing to increased conversion rates.

Support diverse payment sources: Accept payments from PayPal balance, bank cards and bank transfers.

Quick Setup: Easily connected to WooCommerce without requiring complex technical skills.

Buyer Protection: Support dispute resolution mechanism, helping customers feel more secure in transactions.

Some limitations to note:

High transaction fees: Especially disadvantageous with international payments or when there are currency conversions.

Off-site payment: Buyers will be redirected to the PayPal site, which can disrupt the shopping experience.

👉 With the above characteristics, PayPal Gateway is a suitable choice for stores targeting international customers, needing a reputable and familiar payment method.

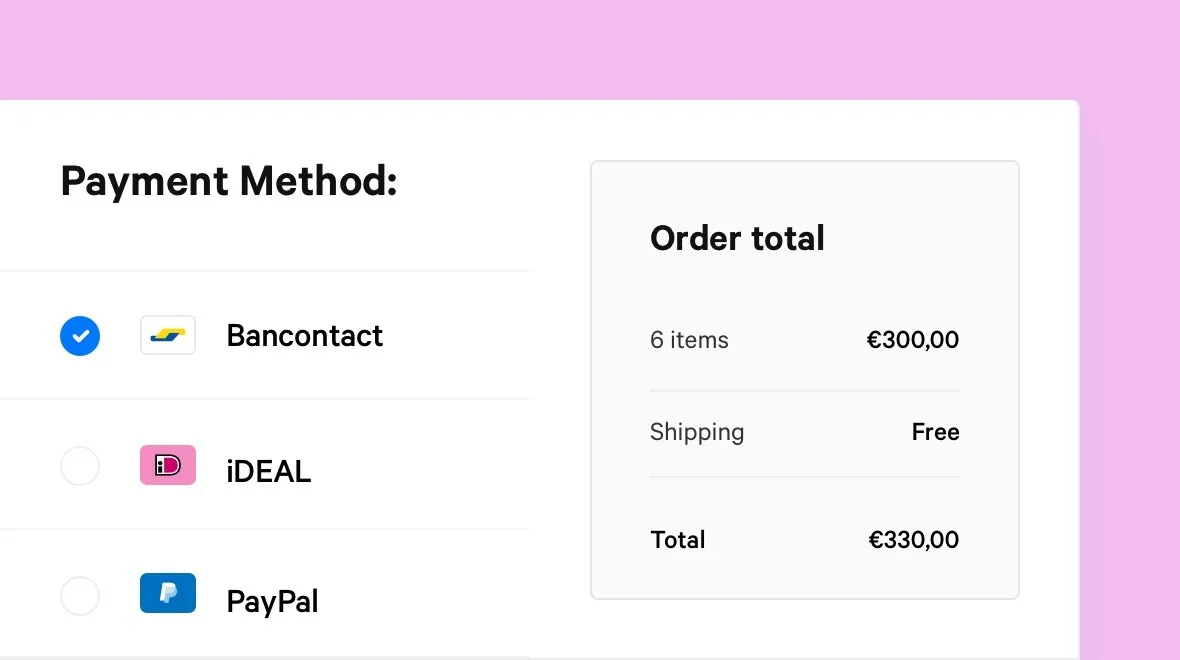

3.4. Mollie

Mollie is a popular WooCommerce payment plugin in Europe, allowing stores to easily integrate multiple domestic and international payment methods. This plugin is user-friendly, easy to configure and supports popular forms such as iDEAL, Bancontact, SEPA Direct Debit with many types of credit cards.

Mollie's outstanding advantages:

Domestic payment support: Offers familiar European methods such as iDEAL and Bancontact.

Flexible costs: Pay only based on actual transactions, fees vary by payment method.

Various payment methods: In addition to domestic methods, credit cards, Apple Pay and PayPal are also supported.

Programmer Friendly: Detailed API and clear documentation, easy to customize integration.

Limitations to note:

Focus range: Best suited for stores operating in the European market.

Non-fixed costs: Fees vary by payment method, which can make budgeting difficult.

👉 With these advantages, Mollie is the ideal solution for European-focused merchants who want to offer both domestic and international payments without paying a fixed monthly fee.

3.5. Paystack

Paystack is considered one of the leading payment platforms in Africa, helping businesses accept payments online and on mobile devices quickly. Paystack's WooCommerce plugin integrates multiple payment methods, supports local currencies and ensures fast payment receiving speed, making it a reputable choice for sellers in the region.

Paystack's outstanding advantages:

Local multi-currency support: Allows transactions in Naira (Nigeria), Cedi (Ghana) and many other currencies.

Various payment methods: Including bank cards, transfers, USSD and e-wallets.

Fast processing speed: Revenue is usually credited to the account within 24 hours.

Optimize mobile experience: Smooth, user-friendly payment interface on smartphones.

Limitations of Paystack:

Limited operating range: Mainly supports African countries, less suitable for the global market.

International transaction costs: International card processing fees are usually higher than domestic cards.

👉 With the above advantages, Paystack is the ideal solution for sellers operating in Africa, wanting a safe, fast and optimized payment system on mobile devices.

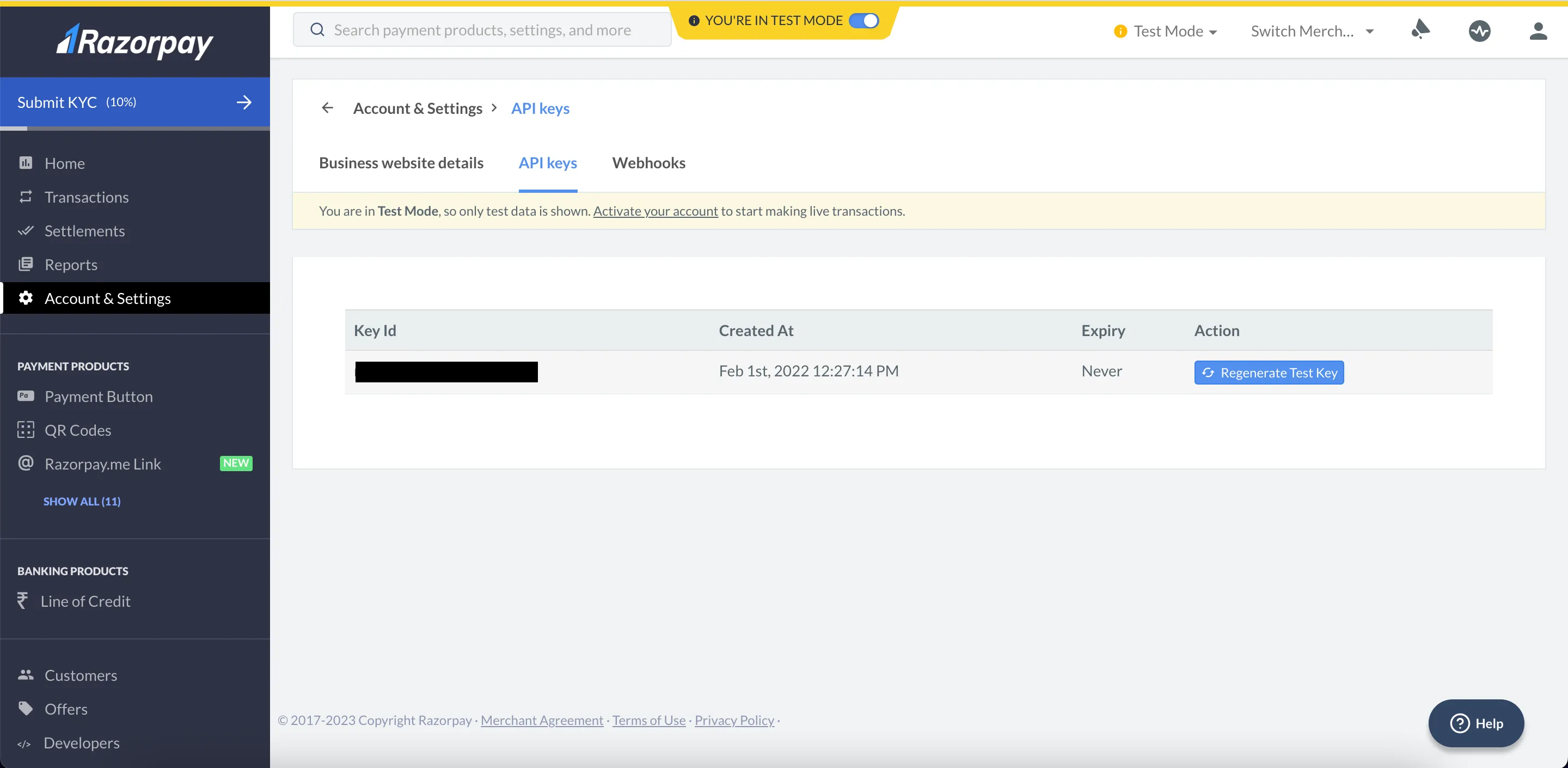

3.6. Razorpay

Razorpay is a fast-growing payment platform in India that stands out for its ability to support multiple payment methods with a single integration. Razorpay’s WooCommerce plugin allows payments via credit cards, debit cards, UPI, popular e-wallets, and also supports EMI installments, providing a seamless payment experience for customers.

Outstanding advantages of Razorpay:

Various payment methods: Includes UPI, cards, EMI, online banking and 100+ other options.

Support recurring payments: Suitable for businesses providing subscription services.

Developer-friendly API: Allows for advanced customization and integration.

Quick registration: Create an account and get approved in no time.

Limitations of Razorpay:

Focus on domestic market: Mainly serving sellers in India, not yet expanding strongly internationally.

Time to receive money: In some cases, it may take several days for the transfer to be processed.

👉 With the above features, Razorpay is suitable for businesses in India looking for a flexible payment solution, fully supporting domestic methods, meeting both one-time and recurring payments.

>>> Learn more: eBay vs Amazon: Which Platform is Best for Dropshipping?

4. How to choose the right WooCommerce payment plugin for your store and target customers

With so many WooCommerce payment plugins available, the best choice will depend on the type of product you sell, the market you’re targeting, and your customers’ payment habits. Having these factors in mind up front will help you avoid costly changes later.

Some suggestions for you:

Local Retailers Go Online: Choose a plugin that supports popular currencies and payment methods in your region, such as Mollie in Europe, Razorpay in India, or Paystack in Africa.

Business providing services on subscription basis: Prioritize plugins that have recurring payments and subscription management features, such as Stripe or Razorpay.

International e-commerce store: It is recommended to use a plugin with global coverage and multi-currency support like Stripe or PayPal.

Small startups, few technical resources: Choose a plugin that is easy to install, quick to configure, and integrates directly with WooCommerce, such as WooCommerce Payments.

Industries that require high reliability or target new customers: Consider reputable brands like PayPal to build trust from the start.

Choosing the right plugin not only helps optimize the checkout experience, but also reduces purchase barriers, increases conversion rates, and supports effective transaction management in the long term.

>>> Learn more: Which Proxy Should You Buy for Facebook? Amazon? Instagram? Shopify? …

5. Notes when installing WooCommerce payment plugin

Enabling a payment plugin is just the beginning. To ensure stable and secure operations, you need to install it correctly and apply best practices to reduce payment issues, prevent fraud risks, and provide a satisfying customer experience.

5.1. Notes for smooth payment plugin installation

A clear implementation plan will help the plugin run smoothly from the start:

Testing before official: Use sandbox mode or test mode to test the transaction.

Enable SSL: Protect your checkout page with HTTPS certificate.

Guaranteed compatibility: Check plugin with WooCommerce version and other important features.

Updated regularly: Always maintain the latest version for optimal security and performance.

Following the steps above will help you avoid technical errors and minimize troubleshooting time.

5.2. Security and anti-fraud notes

A secure payment system protects both businesses and customers. Some measures to take:

Advanced Authentication: Turn on 3D Secure or two-factor authentication.

Track transactions: Check for unusual signs such as many small orders in a row or suddenly large orders.

Limit the number of failed payments: Prevent bot attacks by limiting the number of failed attempts.

Manual refund verification: Carefully review refund requests to avoid fraud.

Following these principles will help you build credibility, gain customer trust, and reduce the risk of disputes.

>>> Learn more: Best Antidetect Browser: Top Pick for Managing Multiple Accounts

6. Conclusion

Choosing the right WooCommerce payment plugin is not just about listing features, but more importantly, finding a solution that meets your store's operational needs, customer payment habits, and long-term development orientation.

If you need a simple, easy to integrate solution, WooCommerce Payments is a reliable starting choice. With global expansion and many advanced features, Stripe almost irreplaceable PayPal has always been a familiar name to build trust for international customers, while Mollie, Paystack and Razorpay again prominent in each specific regional market.

No matter which plugin you choose, make sure you test it thoroughly, ensure it’s secure, and monitor its performance regularly. A seamless, secure checkout experience will help turn new customers into long-term loyal customers.

7. FAQ

1. Does WooCommerce have payment gateways available?

Yes. WooCommerce is available WooCommerce Payments, and supports many other solutions such as Stripe, PayPal, Mollie, Paystack and Razorpay.

2. How to install WooCommerce payment plugin?

In WordPress, go to WooCommerce → Settings → Checkout, select the desired plugin, install, enter credentials and test with mode sandbox.

3. Which payment method is best for WooCommerce?

This depends on your needs Stripe has global coverage, WooCommerce Payments delivering a seamless experience across supported countries, while PayPal help increase credibility with customers worldwide.

4. Does WooCommerce Payments use Stripe?

Yes. WooCommerce Payments operates on the infrastructure of Stripe, but managed directly within WooCommerce.

5. Which payment gateways are suitable for high-risk industries on WooCommerce?

Authorize.net and Stripe are popular choices thanks to their advanced anti-cheat tools.

6. Which payment gateway is best for WordPress?

With WooCommerce: WooCommerce Payments, Stripe, PayPal.

With other platforms: Authorize.net or Square.

Related Blogs

Chrome net internals DNS is an advanced feature built into the Google Chrome browser, allowing users to monitor and manage DNS activities effectively. One of the outstanding uses of this tool is to support clear DNS cache, thereby improving browser performance and enhancing security. In the article below, Antidetect Browser Hidemium will introduce details about chrome://net-internals/#dns as well[…]

Changing IP addresses on iPhone and Android phones is a simple trick but brings many important benefits to users. Not only does it help access geo-restricted content, changing IP also helps increase security, avoid being tracked, and improve access speed. Let's Antidetect Browser Hidemium Discover detailed instructions below!1. Why should you change the IP address on your phone?When you are[…]

Một ngày đẹp trời mở hidemium lên tạo profiles mà anh em thấy thông báo hiển thị lên như này Điều này mách bảo anh em phải nâng cấp lên gói cao hơn rồi đấy.Hôm nay Đạt Văn Tây tôi sẽ hướng dẫn anh em nâng cấp lên gói cao hơn nhé. Đầu tiên anh […]

In the era of strong social network development,Thread has quickly become a potential platform for content creators, businesses and influencers to exploit opportunities to reach users and build a sustainable source of income. If you are wondering how to make money on Threads, you're not alone. Especially after Threads became deeply integrated into Instagram's ecosystem, the platform became even[…]

Job Scrape data from Instagram's Explore page can yield valuable insights, from new content trends, user behavior to emerging influencers. However, the process is not as simple as many people think, especially when you want to Collect data at scale while ensuring compliance with platform policies.In this article, Hidemium will guide you on how to collect data from Instagram effectively, introduce[…]

In the digital era, no-code automation has become an essential trend for individuals and businesses to optimize their workflows. However, many people struggle with automation due to a lack of coding skills, making repetitive task automation seem out of reach.So how can someone with no coding background still create powerful automation scripts?The answer lies in the AI Prompt Script on Hidemium –[…]

.png)