In online business, the Stripe holds the payment is always a stressful issue for businesses. Delayed disbursement not only disrupts cash flow, affects the payment process to suppliers but also creates additional pressure on daily operations. In this article, Hidemium Antidetect Browser will analyze in detail Why Stripe Holds Payments, How Long They Last, and What You Can Do to Prevent It in the Future.

1. What does Stripe hold payment mean?

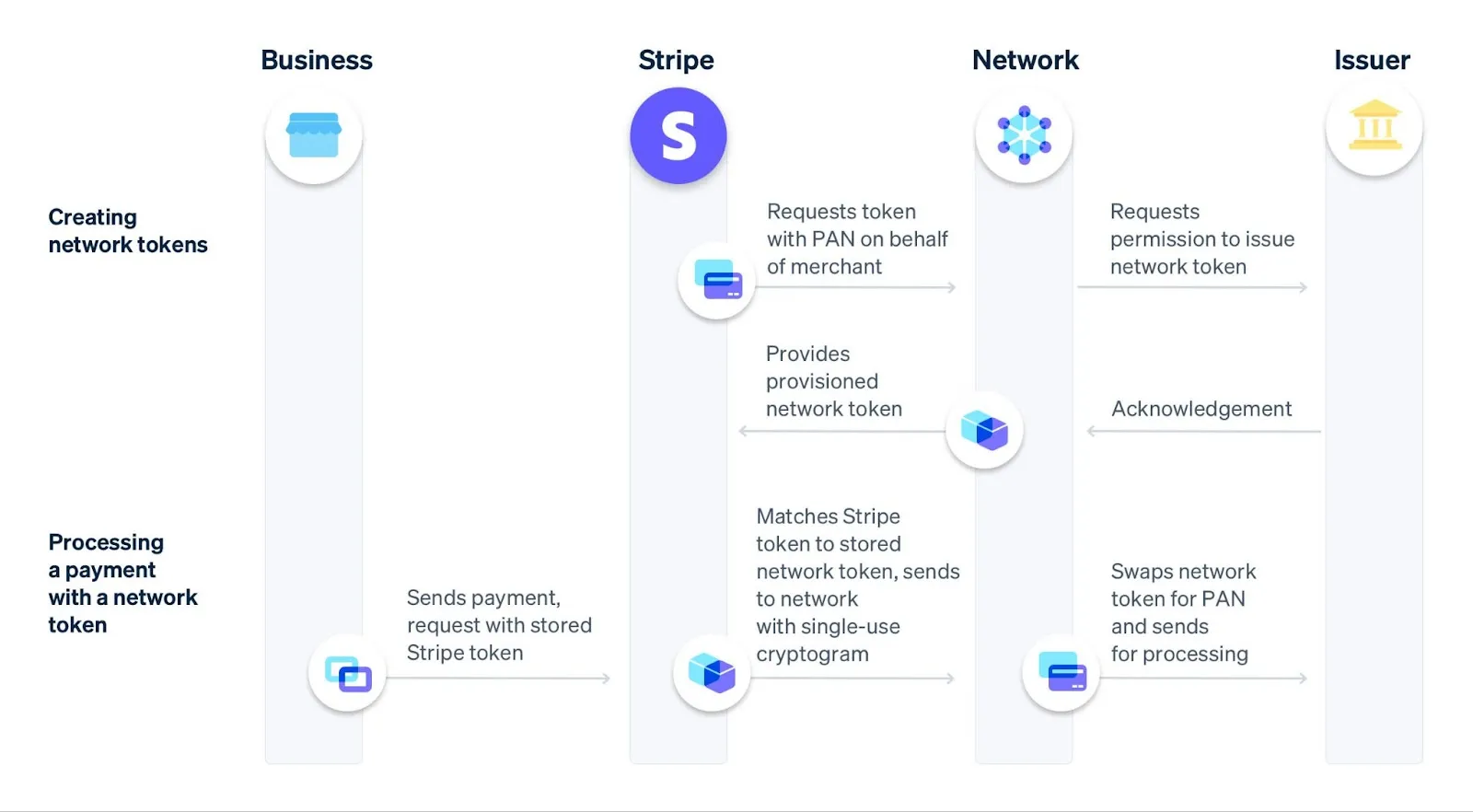

When Stripe places a hold on funds, it means that a transaction from a customer has been recorded but has not yet been released to your bank account. Typically, Stripe will release the funds within a few business days (usually 2 days in the US after processing the transaction). However, if Stripe places a hold, the payment will be in Pending balance instead of being disbursed immediately.

The main cause comes from risk management mechanisms. Stripe acts as both a payment processor and a fraud monitoring and prevention system. Their job is not only to transfer your money, but also to protect cardholders and banks from risks like fraud or chargebacks. If Stripe detects unusual or high-risk activity, it may decide to hold a payment until it has been fully verified and secured before releasing it.

>>> Learn more: What is a Stripe account? How to create and use Stripe

2. Why does Stripe hold payments?

Stripe doesn't always provide detailed reasons for holding payments. However, there are some common reasons businesses often encounter:

High risk industries: Industries like online coaching, dropshipping, subscription services, software, and supplements are often heavily regulated by Stripe. These are industries that are prone to chargebacks (chargeback) or dispute, so the payment time may be longer than usual.

Revenue growth surge: When your sales increase unexpectedly, for example from $2,000/week to $20,000, Stripe's system may see this as a sign of risk. Even if the increase is legitimate, Stripe may still hold some or all of the money until verification is complete to prevent fraud.

High chargeback rate: A chargeback occurs when a customer asks their bank to reverse a transaction. If your chargeback rate exceeds 0.75%, Stripe will consider the account high risk and may withhold current or future payments.

KYC verification process not completed: Stripe strictly adheres to “Know Your Customer” (KYC) regulations. If your profile is not up to date or you have not provided sufficient documentation, Stripe reserves the right to hold the payment until the verification process is completed.

Violation of Terms of Service: Stripe may also withhold funds if it detects a business violating its policies, such as selling prohibited products, misleading information, or suspicious transactions.

👉 In summary, Stripe's payment hold is primarily to mitigate risk and protect both the platform and its customers. Businesses need to understand these factors to comply with the policy and minimize the possibility of unwanted payments being held.

>>> Learn more: Review of the best WooCommerce payment plugins today

3. How long can Stripe hold payments?

How long does Stripe hold payments? not fixed and depends on the specific situation. In normal transactions, Stripe only holds funds for a few days to verify information. However, in high-risk cases, this period can be much longer.

For reputable businesses, low risk: Stripe typically disburses after about 2 days.

For new accounts: first payment may take 7 days or longer.

When Stripe detects a risk factor: funds may be held in 30, 60, 90, even 180 days. Stripe may also extend 90 days and will notify details via email.

From the seller's perspective, having money held for 3–6 months clearly has a negative impact on cash flow. But from Stripe's side, this is how they protect themselves from the risk chargeback or disputes may arise weeks later. Stripe's goal is to always maintain a reserve fund to handle potential risks.

4. What happens when Stripe holds a payment?

When Stripe holds a payment, the funds won't appear in your bank account immediately, but will show up in the “pending balance” on the Stripe dashboard.

Holding money can take many different forms:

Hold temporarily: Stripe simply delays the payment to verify further information.

Freeze account: With high risk, you may be restricted from withdrawing funds or receiving new payments.

Permanent account termination: In the most severe cases, Stripe may close the account entirely and withhold funds until 180 days. This typically happens when Stripe deems a business to be too risky or violates service policies.

👉 It can be seen that Stripe holding payments is both a risk management measure for them and a factor that puts a lot of pressure on cash flow and operations of the business. Therefore, sellers need to proactively understand this policy to minimize risks and optimize the payment process.

5. How does Stripe holding payments affect businesses?

The most obvious impact is cash flow. When Stripe holds a payment, your revenue is disrupted: you can still place orders and serve customers, but you can't use the money to pay suppliers, pay employees, or spend on advertising. For small businesses, this can be a serious risk.

Besides, brand reputation Customers expect quick refunds or on-time delivery, but when they can’t access their held funds, service can be slow, frustrating, and lead to disputes. This inadvertently creates a vicious cycle: the more disputes there are, the more likely Stripe is to continue holding the funds.

Finally, Stripe accounts can be directly affected. If there are too many chargebacks or unusual transactions, Stripe may suspend or terminate your account. At that point, withdrawing funds becomes much more difficult, forcing you to find an alternative payment solution.

6. How to handle when Stripe holds payment

The good news is you still can speed up disbursement process If applied correctly:

Maintain professional communication: Contact Stripe support in a calm manner, providing your account ID, transaction details, and a clear request. Avoid complaining or getting angry, as professionalism will help you get a more positive response.

Prepare supporting documents: Provide legal proof like business license, supplier invoice, proof of delivery, refund policy or bank statement. The more transparent you are, the easier it is for Stripe to release funds to you sooner.

Reduce chargeback rate: Stripe rates account security based on the number of disputes. To reduce chargebacks, describe products clearly, ensure delivery as promised, support quick refunds, and always send tracking codes to customers.

Diversify payment channels: Don’t rely solely on Stripe. Maintain a backup payment gateway like PayPal, Square, or a merchant account for high-risk industries. That way, if Stripe holds the funds, your entire cash flow won’t be cut off.

7. How to stop Stripe from holding future payments

“Prevention is better than cure” – to avoid Stripe withholding money, businesses need to build account profiles transparent and complete from the start. When setting up your account, provide as much information as possible about your products, business model, and sales policies.

Additionally, if a sudden increase in sales is expected, such as when implementing a big marketing campaign, be proactive in notifying Stripe. This helps the system not to consider the growth as unusual, thereby reducing the risk of payment being held.

Another important factor is Maintain chargeback rate below 1%. To achieve this, businesses need to focus on customer experience, be transparent about their return policies, and handle complaints quickly. Stripe closely monitors dispute rates, so keeping them low will help keep your cash flow more stable.

At the same time, take advantage of the anti fraud tools like 3D Secure, address verification (AVS), and fraud filtering. When Stripe sees you actively protecting transactions, they have less reason to hold onto your funds.

In case of activities in the field considered as a high risk industry, you should consider using the Dedicated payment account. Although the costs are higher, these providers are often flexible and rarely hold back your money.

8. Are there any alternatives to Stripe?

Stripe is known for its ability to Fast integration, powerful API and supports multiple business models. However, if Stripe frequently holds funds and causes disruption to operations, you may want to consider some alternatives such as PayPal, Square, Braintree or EasyPayDirect.

These platforms all offer online payment services, but each has its own risk and disbursement policies. Some still have a holding mechanism, but the level of flexibility may be more appropriate depending on the business sector.

When comparing, pay attention to the following factors: transaction fees, industry support, risk tolerance and integration capabilities. No vendor is perfect, but Distribute transactions across multiple payment channels will help businesses minimize risks, ensuring stable cash flow even if one party withholds payment.

>>> Learn more: Top 10 Cheap Stripe Alternatives for Business

9. Conclusion

Placing a payment on Stripe can feel like a sudden “clogging” of your cash flow. Instead of being transferred to your bank, the money is held for review, leaving you to figure out why. Typically, the cause is a risk factor: your business is in a sensitive industry, sales are up, chargebacks are high, account verification is incomplete, or policy violations are suspected. The hold can be as short as a few days, but in some cases it can last up to 180 days, greatly affecting cash flow and brand reputation.

The solution lies in proactive management: Maintain transparent communication with Stripe, provide full verification documents, limit disputes from arising, and prepare additional backup payment channels. This way, you can reduce the risk of Stripe holding funds in the first place and quickly recover if the situation arises.

Remember that Stripe is just being cautious to protect the payment system. Understanding how Stripe works and why it holds funds will help you adjust your business strategy accordingly protect stable cash flow, and maintain customer confidence.

10. FAQ – Answering questions about Stripe holding payments

1. Does Stripe hold payments?

Yes. Stripe may withhold funds when it detects risk or unusual activity.

2. What happens if a payment is held?

The funds will remain in Stripe's reserve fund and will only be released once the verification process is complete.

3. Can users pause payments on Stripe themselves?

No. Only Stripe has the right to withhold payment.

4. Does Stripe keep the first payment?

Yes. For new accounts, Stripe typically holds the first payment for verification.

5. How long does Stripe hold payments?

Usually from7–14 days, but some cases can last up to90–180 days.

6. Are Stripe payments slow?

Yes. Delays may occur due to the review process, high risk accounts, or the banking system.

Related Blogs

Have you heard of TikTok SEO? It’s not just a trend but a "golden" tool that helps your videos stand out among millions of other content on the platform. TikTok SEO works similarly to website SEO—optimizing keywords, analyzing data, and implementing strategies to ensure your content appears in the right place at the right time.According to a study by Google, 40% of today's younger generation use[…]

In the fiercely competitive world of YouTube, having a large number of subscribers not only helps you increase your influence but also opens up many new opportunities for your channel. So why are subs important and how to increase this number quickly and effectively? Let's explore!1. Why are YouTube subscribers important?In today's competitive YouTube world, owning a channel with many subscribers[…]

Have you suddenly received a notification that your YouTube account has been suspended for no apparent reason? Millions of users find themselves in a similar situation every year, losing access to their channels, losing videos, and potentially losing all the hard work they’ve put into building their communities. YouTube account suspensions can be caused by a variety of reasons, from community[…]

TikTok is not just an entertainment app but also a "goldmine" for content creators and brands to generate massive income. However, to make your posts on TikTok attract millions of views, selecting the ideal posting time—often referred to as the "golden hour"—is a crucial factor in increasing engagement and effectively connecting with your audience.1. What is the "golden hour" for posting on[…]

.png)

.png)