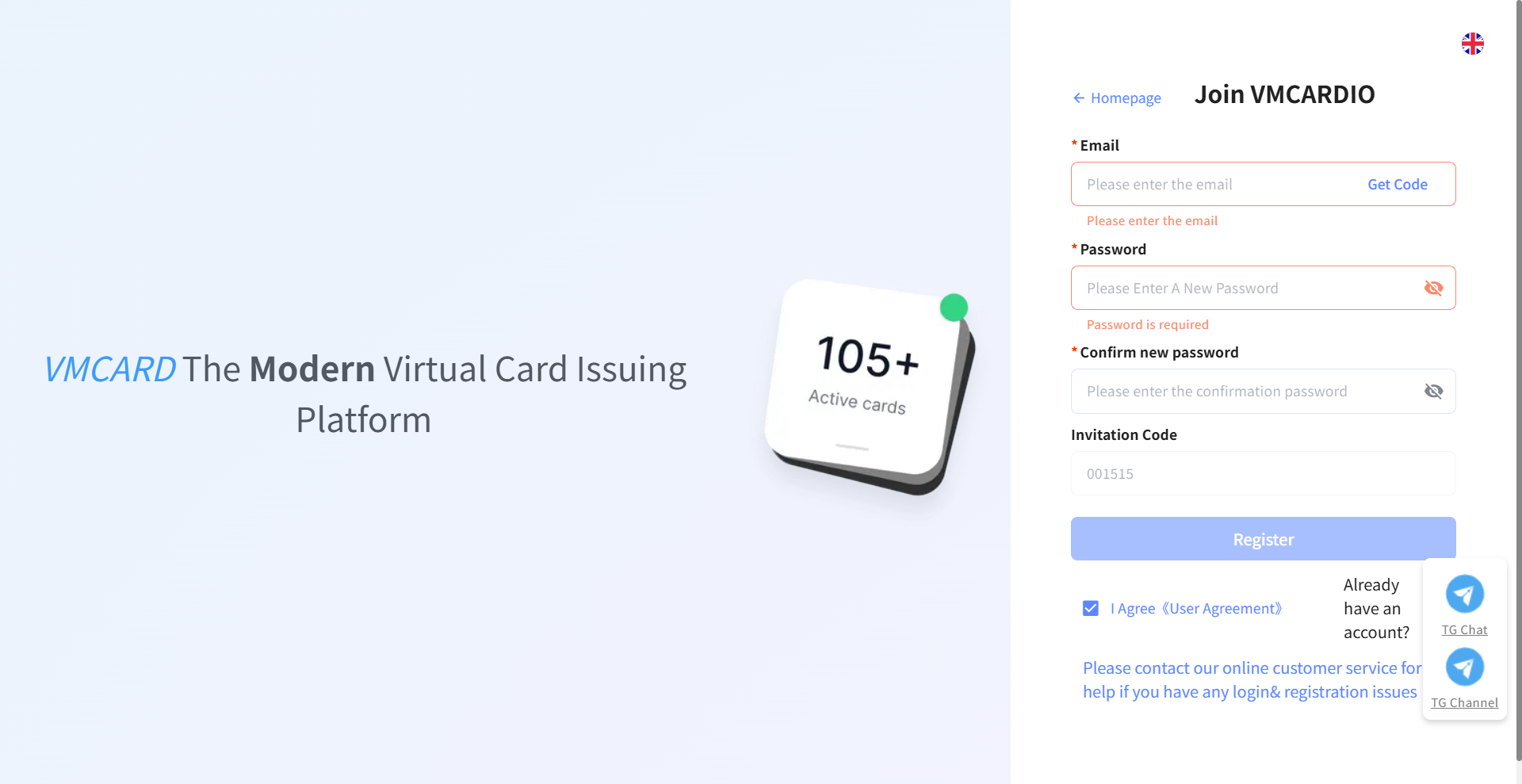

Vmcard2025: Enterprise Card Issuing for Multi-Account Success

When you open new ad accounts, subscribe to AI/SaaS tools, scale cloud resources, or verify stores, payment failures can derail the plan: card binding fails, extra 3DS checks pop up, renewals don’t charge. Most of the time it isn’t a random glitch—it’s the merchant’s risk engine asking for better signals. This article explains the common payment-side causes and gives you a practical, copy-and-run playbook to raise your success rate.

Who is this for

• Performance marketing teams running FB/Google/TikTok at scale

• Store operators and cross-border sellers managing many properties

• AI/SaaS users who rely on stable recurring payments

• Devops teams paying for cloud and usage-based services

Why payments fail (payment-side only)

BIN / region / currency mismatch between card and merchant settlement, which raises risk weighting and triggers 3DS/step-up checks.

Incomplete or inconsistent billing data: name, billing address, and ZIP/Postal (AVS) missing or mismatched.

Aggressive first transaction: a new account with a large amount or rapid retries is treated as higher risk.

One card, many accounts/merchants in a short window, stacking risk signals.

High refunds/voids or frequent “soft declines” (insufficient balance), which invite more checks or lower trust.

Unstable recurring charges: balance not ready on billing day, repeated failures push the account into strong verification.

How to Get Started:

Sign Up – Register your account on Vmcard within minutes.

KYC Verification – Complete identity verification to activate your account securely.

Three Vmcard formats for affiliates

· Debit cards – Individual cards with their own balances; map 1:1 to specific ad accounts for long-running, steadily scaling funnels.

· Credit cards – Multiple cards drawing from a shared wallet limit; set per-card daily/weekly/monthly caps and reallocate budget on the fly for team campaigns.

What Vmcardchanges

• Scenario-matched BIN matrix: purpose-built card ranges for ads, subscriptions, cloud, and store verification to improve bind and authorization pass rates.

• Segmented card pools and policies: structure cards by business line/country/merchant type, set billing data, limits, and whitelists to reduce profile jumps.

• Step-up friendly limits: configurable “small-first, then ramp” model that lowers 3DS frequency as trust builds.

• Pre-auth and recurring stability: test with small pre-auth, keep cushions before billing, and switch to backup cards on first failure.

• Bulk and automation: batch issuance, batch limits, and an open API to plug card lifecycle into your internal tools and RPA.

• Enterprise controls: roles/permissions, audit trails, and per-line reporting for finance and ops.

• Pay-only model: top up and spend; no incoming payments. Clearer ledgers, simpler control, and easier compliance.

Three-step playbook to cut failures

Step 1 — Align billing

Complete name, billing address, and ZIP/Postal immediately after issuance. Align with the merchant’s settlement country when possible. Prefer same-currency settlement.

Step 2 — Bind and first charge, start small

Run a $1–$3 pre-authorization. If the same card fails up to 2 times, switch to a better-matched BIN instead of stacking more failed attempts. Use a staged curve:

Day 1: $5–$20 test

Day 3–5: $50–$200 (depending on merchant and account weight)

Week 2+: ladder up daily/weekly limits; run a small probe charge before each step-up.

Step 3 — Make recurring charges boring

Maintain a balance cushion ≥ 3× the recurring fee by the day before billing (T-1). If the first charge fails, immediately swap to a backup card to avoid a second failure that can trigger strong verification.

Scenario recipes (examples)

• New ad accounts: ads-oriented BINs + low initial limits + weekly ramp; prioritize stable authorization, minimize refunds.

• AI/SaaS subscriptions: subscription-friendly BINs + recurring safeguards + T-1 balance cushion to avoid renewal-day surprises.

• Cloud expansion: pre-auth-friendly BINs + staged capacity increases + a small probe before each limit raise.

• Store verification / payment tools: pre-auth-friendly BINs + “one card, one purpose” to reduce random audits.

Common pitfalls to avoid

• Brute-forcing retries: stacked failures only push risk scores higher.

• One card for every platform: cross-scenario use creates profile jumps that invite step-ups.

• Big first ticket: large amounts on a new account are a red flag.

• Treating refunds as routine: frequent original-route refunds attract attention—use internal credits/vouchers when possible.

Why teams choose VMCard

• Higher pass rates: scenario-matched BINs and policy controls improve binds, auths, and recurring stability.

• Faster cycles: real-time top-ups and streamlined issuance shorten the path from test to scale.

• Built to scale: API + bulk ops + segmented pools = structured growth without chaos.

• Audit-ready: roles, logs, and line-level reporting keep finance, risk, and ops aligned.

Quick checklist

[ ] Complete billing name, address, ZIP/Postal to match the merchant’s country

[ ] Run a $1–$3 pre-auth; if it fails up to 2 times, switch BINs

[ ] Day 1 small test → Day 3–5 step up → Week 2 ladder limits with probe charges before each step

[ ] Keep ≥ 3× the recurring fee by T-1; swap to a backup card on the first failed renewal

[ ] One card, one use: bind each card to 1–2 accounts/merchants max

[ ] Prefer internal credits/vouchers over original-route refunds when feasible

FAQ

Q: Why does card binding keep failing?

A: Most often billing data is incomplete/mismatched, or the BIN doesn’t fit the merchant’s region/currency. Complete billing data, switch to a better-matched BIN, and run a small pre-auth.

Q: 3DS shows up too often. What can I do?

A: It’s a risk step-up. Follow a small-first laddered limit curve, cut retries, and change to a more suitable BIN. Frequency usually drops as the profile stabilizes.

Q: Renewals fail repeatedly—how do I fix that?

A: Maintain a T-1 balance cushion ≥ 3× the fee and switch to a backup card on the first failure to avoid getting pushed into strong verification.

Q: Can Vmcardaccept payments?

A: No. Vmcardfollows a pay-only model: top up and spend; incoming payments are not supported.

Q: Can I automate at scale?

A: Yes. Use the API for issuance, limits, pool segmentation, and monitoring; connect it with your internal systems or RPA.

Open your Vmcardenterprise account today, get a scenario-matched BIN plan and a ready-to-run ramp-up curve, and start reducing payment failures right away.

Sign up: https://vmcardio.com/zh/register?code=001515

Related Blogs

Need to use multiple accounts or storefronts to service your online business? But usually, this will cause many dangers because of browser fingerprinting problems. So is there a way to optimize the management of these multiple accounts? Benefits of running multiple accounts Social networking and e-commerce platforms have become extremely popular in today’s internet world, and the trend of[…]

Bước 1: Anh em chọn profiles cần update nhé, xong chọn Update Multiple Trong màn hình Update Multiple Profiles anh em lựa chọn thay đổi hàng loạt những tính năng cần update nhé. Sau đó ấn Update. Ok mọi thứ đã được update theo cấu hình ta vừa lựa chọn.

Every time you access the internet, a slew of hidden trackers silently collect data about your device — from IP address, system configuration to how the graphics card displays images. Tools Pixels can helps you clearly detect the extent to which your “digital fingerprint” is exposed online.In this article, togetherHidemium discovers What is Pixelscan, how it works, what are its features and when[…]

In the era of booming AI technology, Claude AI is emerging as a powerful tool for streamlining automation processes. But what exactly is Claude AI, and how can you use it to generate intelligent automated Prompt Scripts? This article will explain in detail and share SEO strategies that can boost your website ranking by leveraging this topic.1. What is Claude AI? Overview of an Advanced AI[…]

Digital Footprint, also known as digital footprint, is the sum of all the data you leave behind as you move around the Internet. Every click, post, share, or even search contributes to your online presence.So why does your digital footprint matter? Because it reflects your entire digital behavior – from what you disclose to hidden data like metadata attached to photos or browser information. This[…]

Facebook Ad Credits are an important concept for those who are running ads on this platform, especially in the context of Facebook regularly launching attractive incentive programs. If you are looking to optimize your advertising budget, this is a tool worth considering. Together Hidemium Find out how to make the most of your Facebook ad credits here!1. What is Facebook Ad Credit?Facebook Ad[…]