As more and more users face difficulties with Payoneer — from high fees, payment limits to inaccessibility in some countries — the need to find solutions Payoneer Alternatives is increasing rapidly. Grasping that trend, many new international payment platforms have been born, providing more flexibility in cash flow management, optimizing costs and ensuring smooth cross-border transactions.

Choosing the right platform not only helps you send and receive money more efficiently, but also contributes to improving your overall financial experience. In this article, Hidemium Antidetect Browser will introduce to you reputable Payoneer alternative platforms, suitable for both freelancers and businesses looking for a safe and cost-effective international payment solution.

1. How to choose the right Payoneer alternative? 5 factors not to be overlooked

Before you switch to a new platform, you need to be clear about your needs. Not every service will be right for everyone — it’s important to choose a platform that fits your financial goals and how you operate. Here are five key factors to consider:

Transaction fees and conversion rates: Some platforms may offer low fees but use unfavorable exchange rates. Look for services that use mid-market rates, disclose their fees, and keep exchange rate spreads to a minimum.

Scope of operations and currency support: Make sure the platform supports the country you live in or the region your target customers are in. Some platforms only serve certain regions, while others have a global system that supports multiple currencies.

Transaction speed and reliability: If you need to withdraw money quickly to turn around your capital, check the average processing time and system stability. Slow platforms can disrupt cash flow and affect daily business operations.

Business support & system integration features: Some platforms go beyond just transferring money, offering features like professional invoicing, mass payments, or direct integration with tools like Shopify, QuickBooks, Upwork, etc. to help you automate your payment process and increase productivity.

Reputation and security: Always choose platforms that are licensed by financial regulators, have transparent policies, enthusiastic support teams, and are highly rated by users for their safety and efficiency.

After carefully considering the above factors, you will easily choose the Payoneer alternative platform that best suits your needs and actual conditions.

>>> Learn more: Close PayPal Account and Create New Account Without Getting Banned

2. Comparison table of the most effective Payoneer alternatives today

Now that you have a clear understanding of the factors to consider when choosing an international payment platform, you can refer to the detailed comparison table below. This table will help you easily evaluate the 6 most popular Payoneer alternatives today, based on the criteria: target audience, costs - exchange rates, supported currencies, payment methods and highlights:

Foundation | Who is it for? | Cost & Rates | Currency support | Payment method | Highlights |

| Wise | Individuals and small businesses | From 0.57% + fixed fee, real market rate applied, no spread increase | More than 50 currencies | Domestic bank transfer, debit card | Transparent rates, competitive costs |

| Airwallex | Startups and businesses operating globally | Spread about 0.5% for major currencies, 1% for others; free domestic transfers | 60+ currencies; payments to 150+ countries | Bank transfer, corporate card | Flexible multi-currency wallet, powerful API support |

| Revolut Business | Freelancers and Remote Workers | Low fee for basic plan; additional fee if free limit exceeded | Over 25 currencies in standard package | Bank transfer, virtual card | Multi-currency account with integrated expense management tools |

| Tipalti | Businesses with large payment needs | Custom fees based on trading volume | Over 190 currencies | Bank transfer, PayPal and other platforms | Automate payments, integrate tax processing and regulatory compliance |

| Mural Pay | Small businesses using cryptocurrency | Extremely low fees when paying with stablecoins | 10+ cryptocurrencies and stablecoins | Stablecoin wallet, bank transfer | Real-time transaction tracking via blockchain |

| PayPal / Stripe | Personal users and e-commerce | Average fees; currency conversion fee around 2–3% | More than 20 currencies | Bank transfer, PayPal wallet | Easy to use, trusted global brand |

Conclude: Each platform has its own advantages. Depending on your priorities – such as cost savings, fast transaction speed or efficient financial management – consider carefully to choose the solution that best suits your personal or business needs.

3. Detailed review of 6 Payoneer alternative platforms

Now that you’ve covered the broad spectrum of Payoneer alternatives, it’s time to dive into each platform to see which one best suits your needs. Each platform has its own strengths — from transaction speeds to transfer costs to tools to help you manage your finances. Choosing the right one depends on how you handle international payments and what features are important to your workflow.

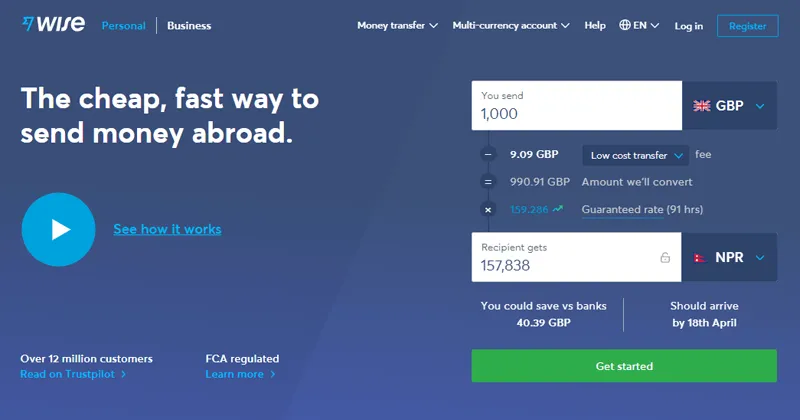

3.1. Wise Business – A transparent and economical Payoneer alternative

Wise Business (formerly TransferWise) is currently one of the most highly rated Payoneer alternatives, especially for those who value transparency in fees and global operations. It is a trusted solution for many freelancers, small businesses and international teams thanks to its fast, low-cost and easy-to-use money transfers.

Wise Business Highlights:

Fair market rates: Wise applies the actual exchange rate as on Google, without adding hidden fees. As a result, users save more than platforms that usually add 2–3% to the exchange rate.

Clear and transparent costs: Before confirming the transaction, you will clearly see the fee to be paid. Most international transactions range from 0.4% to 1%, depending on the route and currency.

Flexible multi-currency accounts: Allows you to manage more 50 currencies in a single account. You can also receive payments with separate account information in countries such as US (USD), Europe (EUR), UK (GBP), Australia (AUD) and many other countries.

Fast, reliable money transfers: Most transactions are processed within the day, even within minutes. Wise is highly regarded for its speed and accuracy in every transaction.

Optimize corporate financial management Features like mass payments, expense tracking, business debit cards, and integration with Xero accounting software make Wise a powerful tool for international financial management.

Who is Wise Business suitable for?

Freelancers and consultants who regularly work with foreign clients

Remote teams or agencies with employees in multiple countries

Small businesses want to reduce money conversion costs and optimize domestic withdrawals

👉 If you are looking for a Payoneer alternative platform that is both transparent, reliable, low cost, then Wise Business is the name worth your consideration.

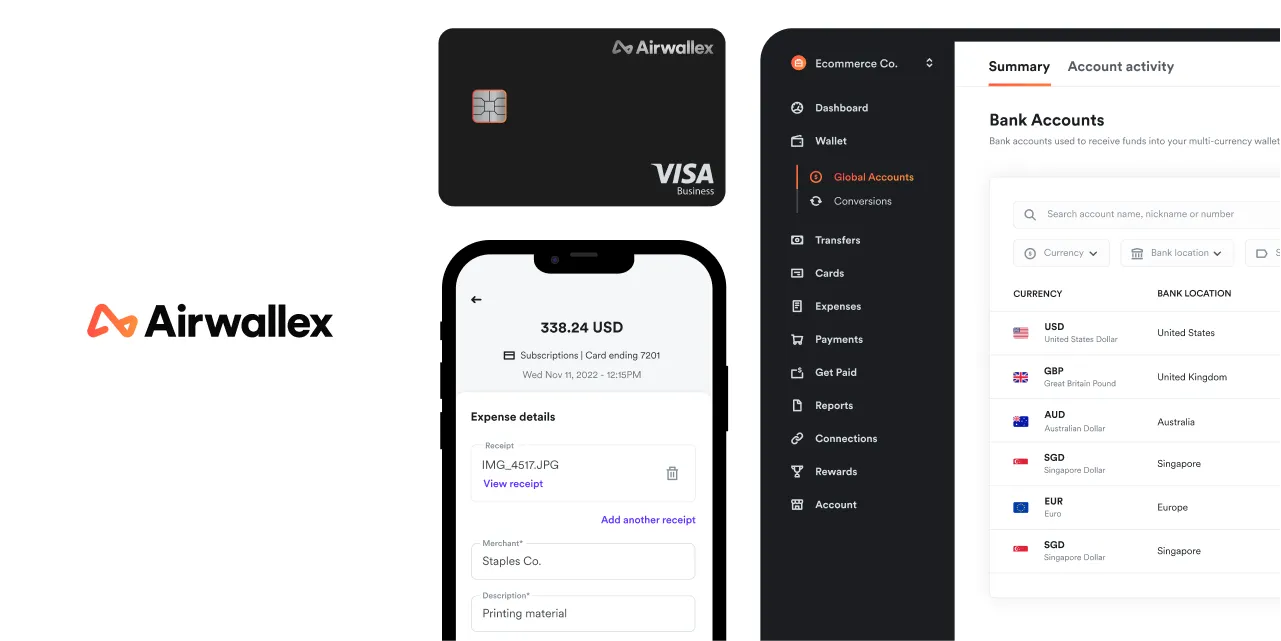

3.2 Airwallex – The Ultimate Payoneer Alternative for Modern Businesses

Airwallex is considered one of the most powerful Payoneer alternatives available today, especially suitable for startup, business-commerceand companies expanding into international markets. Designed specifically for modern business models, the platform provides a comprehensive ecosystem for managing global payment, support flexible transfer, virtual card, and easy integration through API.

Outstanding features of Airwallex:

Competitive rates, low transaction costs: Airwallex applies a spread of just 0.3% to 0.6% on popular currencies. Domestic transactions are usually free, while international transfers via SWIFT cost between $15 and $25 depending on the receiving country.

Multi-currency transaction support: The platform supports over 60 currencies and enables payments to over 150 countries, making it easy for businesses to expand internationally.

Flexible API, easy to integrate: Technical teams can use Airwallex's API to automate payment processes, create virtual accounts, and connect directly to management systems or online sales platforms.

Convenient virtual and physical spending cards: Businesses can issue cards to employees with limited spending and customized access, giving them better budget control across multiple regions.

Business accounts with clear authorization: Supports creating multiple sub-accounts for each group or project, helping to optimize accounting processes and transaction reconciliation.

Airwallex is suitable for the following people:

The startup is in the process of expanding into the international market.

Business SaaS or marketplace need to make regular payments to foreign partners

Companies e-commerce Cooperate with many global suppliers and customers

If your business is looking for a comprehensive international payment solution that offers flexible support and is easy to integrate, then Airwallex Definitely a Payoneer alternative that you should not miss.

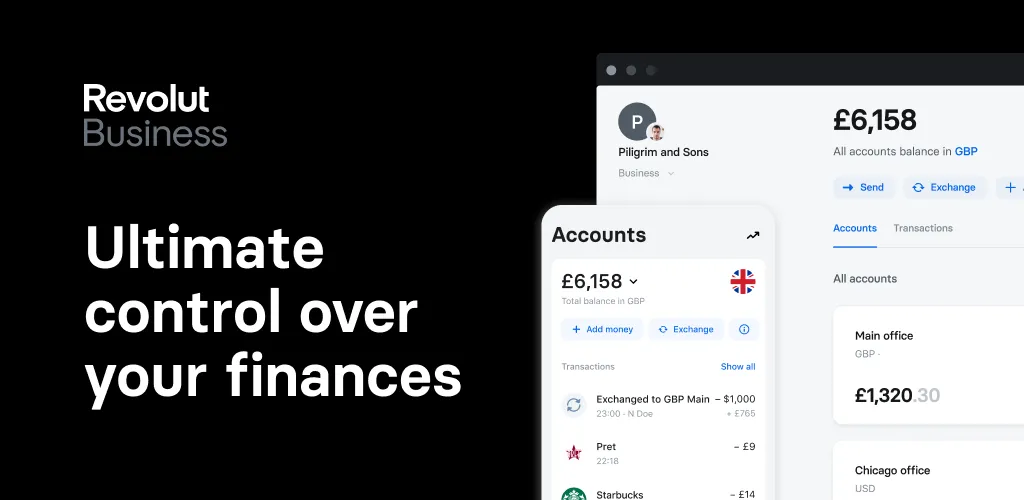

3.3. Revolut Business – Flexible Payoneer Alternative for Freelancers and Small Businesses

Revolut Business is increasingly popular with freelancers, remote teams, and small businesses for its ability to manage finances efficiently, especially across multiple currencies. The platform combines the convenience of traditional business banking with the flexibility of modern financial technology – all in an intuitive, easy-to-use interface.

Revolut Business Highlights:

Multi-currency accounts: Allows you to store, convert and send money in over 25 currencies from a single account – extremely convenient if you regularly trade with international partners.

Competitive exchange rates: Revolut uses the interbank rate during trading hours. With the standard plan, you get free conversions up to a certain limit each month; reasonable fees apply beyond that.

Integrated business support tools: You can create invoices, request payments, budget, and automate financial management processes – all directly from the dashboard.

Physical and virtual cards: Easily issue cards to employees with customizable spending limits, use for online payments, business trips or recurring expenses.

Powerful integration capabilities: Revolut can connect with popular tools like Xero, Slack, Zapier,… to help improve work efficiency and optimize financial processes.

Revolut Business is suitable for:

Freelancers and remote teams need to receive international payments

Startups want a compact, easy-to-implement financial solution

Small businesses are managing cash flow in multiple currencies.

If you are looking for a modern, flexible Payoneer alternative with great control over all your financial transactions, Revolut Business is the reliable choice.

3.4. Tipalti – A Powerful Payoneer Alternative for Large Businesses

Tipalti not just a payment tool, but also a Comprehensive financial automation platform, designed specifically for businesses that need to make large volumes of global payments. If your company regularly pays hundreds or even thousands of collaborators, freelancers, or suppliers, Tipalti is a great Payoneer alternative.

Highlights of Tipalti include:

Mass payments to over 190 countries: Supports a variety of forms such as bank transfer, PayPal, international ACH, and prepaid debit cards, making it easy for businesses to expand their global operations.

Automate tax and compliance processes: The system has built-in tax form collection capabilities such as W-9, W-8BEN and VAT, ensuring compliance with legal regulations in many countries.

Self-service portal for recipients: Partners can proactively update payment information and tax forms without sending emails back and forth, saving time and reducing the burden on the accounting department.

Automate the entire payment cycle From partner onboarding, transaction reconciliation to invoice processing – Tipalti is especially useful for marketplace platforms, affiliate systems or media businesses with high transaction volumes.

Customize look and feel: Allows personalization of the payment experience according to the business's style and identity, helping to increase professionalism and consistency at every touchpoint.

Tipalti is especially suitable for:

SaaS business or affiliate system with large payment volume

Finance department wants to minimize manual operations and optimize processes

Companies with high global tax and legal compliance requirements

If your business is looking for a Payoneer Alternatives, highly scalable and automated, then Tipalti is the enterprise-grade payment platform you shouldn't miss..

3.5. Mural Pay – An effective blockchain payment solution to replace Payoneer

Mural Pay is a modern payment solution that acts as an alternative to Payoneer, with the highlight being the integration of blockchain technology to optimize transaction speed and operating costs. The platform allows businesses to send cross-border payments using stablecoin, offering superior transparency and efficiency – especially suitable for traditional companies that are gradually approaching crypto infrastructure.

Outstanding advantages of Mural Pay:

Pay with popular stablecoins: Mural supports popular stablecoins likeUSDC and USDT, helping to reduce transaction delays compared to the traditional banking system, while limiting the risk of exchange rate fluctuations.

Global money transfer at optimal cost: Thanks to the blockchain network application, Mural offers significantly lower transaction fees, especially effective for businesses with frequent and high-volume international payment needs.

Transparency and real-time tracking: Every transaction is clearly recorded on the blockchain, allowing parties to track it directly and ensuring transparency throughout the entire process.

Supports multiple currencies: In addition to stablecoins, Mural also supports a number of fiat currencies, allowing flexible conversion according to the actual needs of businesses.

Powerful API Integration: Mural provides programming tools and APIs that allow businesses to easily integrate into internal systems, automating payment processes quickly and efficiently.

Mural Pay is suitable for the following subjects:

Startups and technology platforms are implementing crypto applications into operations.

Businesses in areas with limited traditional banking services

The company is looking for a solution cross border payments fast, low cost and transparent

If you are looking for a Payoneer alternative, combining blockchain technology advantages with high applicability in practical operation, then Mural Pay is a worthy choice to improve your business's global payment process.

3.6. PayPal and Stripe – Reliable and Flexible Global Payment Solutions

In the field of online payments, PayPal and Stripe are two familiar platforms trusted by millions of users. Although they cannot completely replace all the functions of Payoneer, but both offer fast, secure, and globally-available payment solutions – especially suitable for businesses that need stability and ease of deployment.

Highlights of PayPal and Stripe:

Wide range of operations: Both PayPal and Stripe are available in over 200 countries and support multiple currencies, making it easy for businesses to reach international customers without payment barriers.

Flexible payment tools:

PayPal offers features like quick payment links, recurring payments and mass transfers.

Stripe Featured with the ability to create custom payment flows, automatic invoicing and integrate direct payments on the website, suitable for e-commerce businesses.

Fast and diverse money transfer: Users can withdraw money to domestic bank accounts, payment cards or e-wallets. Processing time is flexible, it can be just a few minutes or a few business days.

High reliability: With strong brands and widespread popularity, PayPal and Stripe give customers peace of mind when making payments – an important factor in increasing order conversion rates.

Easy technical integration: StripePopular with techies for its powerful API, ideal for SaaS platforms, ecommerce websites, or marketplaces that need to automate payment processes.

Who is PayPal and Stripe right for?

Small and medium-sized businesses want to implement fast, hassle-free payments

Online seller serving global customers

Freelancers need reliability and fast payment

If you are looking for an alternative Payoneer effective, easy to use and globally recognized, then PayPal and Stripe are two options worth considering.

>>> Learn more: Close PayPal Account and Create New Account Without Getting Banned

4. Instructions for transferring from Payoneer to another payment platform

If you are thinking of switching from Payoneer to another payment platform, the process is relatively simple and can be completed in just a few steps. Here is a step-by-step guide to help you make the transition smoothly, avoid unwanted risks, and maintain a steady cash flow.

Step 1: Withdraw all remaining balance in Payoneer account

Log in to your Payoneer account and withdraw the remaining amount to your linked bank account. Double check your pending payments and make sure that automatic withdrawal is turned off (if it is on).

Step 2: Change payment method on the platforms you are using

If you are receiving payments from platforms like Upwork, Fiverr, Amazon, or affiliate programs, update your payment method in your account settings. Many platforms now support popular alternatives like Wise, PayPal, or local bank transfers.

Step 3: Register and set up an account on the new payment platform

Choose the payment platform that suits your needs, sign up, and complete the account verification process (if required). Then, link your bank account or credit card, and set up the currency you typically use to receive payments.

Step 4: Test with a small transaction

Before switching completely to a new platform, make a small transaction (sending or receiving money) to make sure everything is working properly. This is an effective way to detect configuration errors early, avoiding the impact of large payments.

Step 5: Proactively notify customers or partners of changes

If you normally send invoices or receive manual transfers from customers, be clear about the change in payment method. Be sure to include the new account information in your next email or invoice.

Step 6: Maintain a Payoneer account as a backup

There is no need to rush to close your Payoneer account. You should keep your account active for a while, just in case. Once you are completely comfortable with the new platform, you can consider stopping or closing your account.

Switching from Payoneer to another payment platform is not complicated if you follow the right process. With just a few simple steps, you can ensure your cash flow stays smooth and optimize the payment experience for your business.

>>> Learn more: What is a Stripe account? How to create and use Stripe

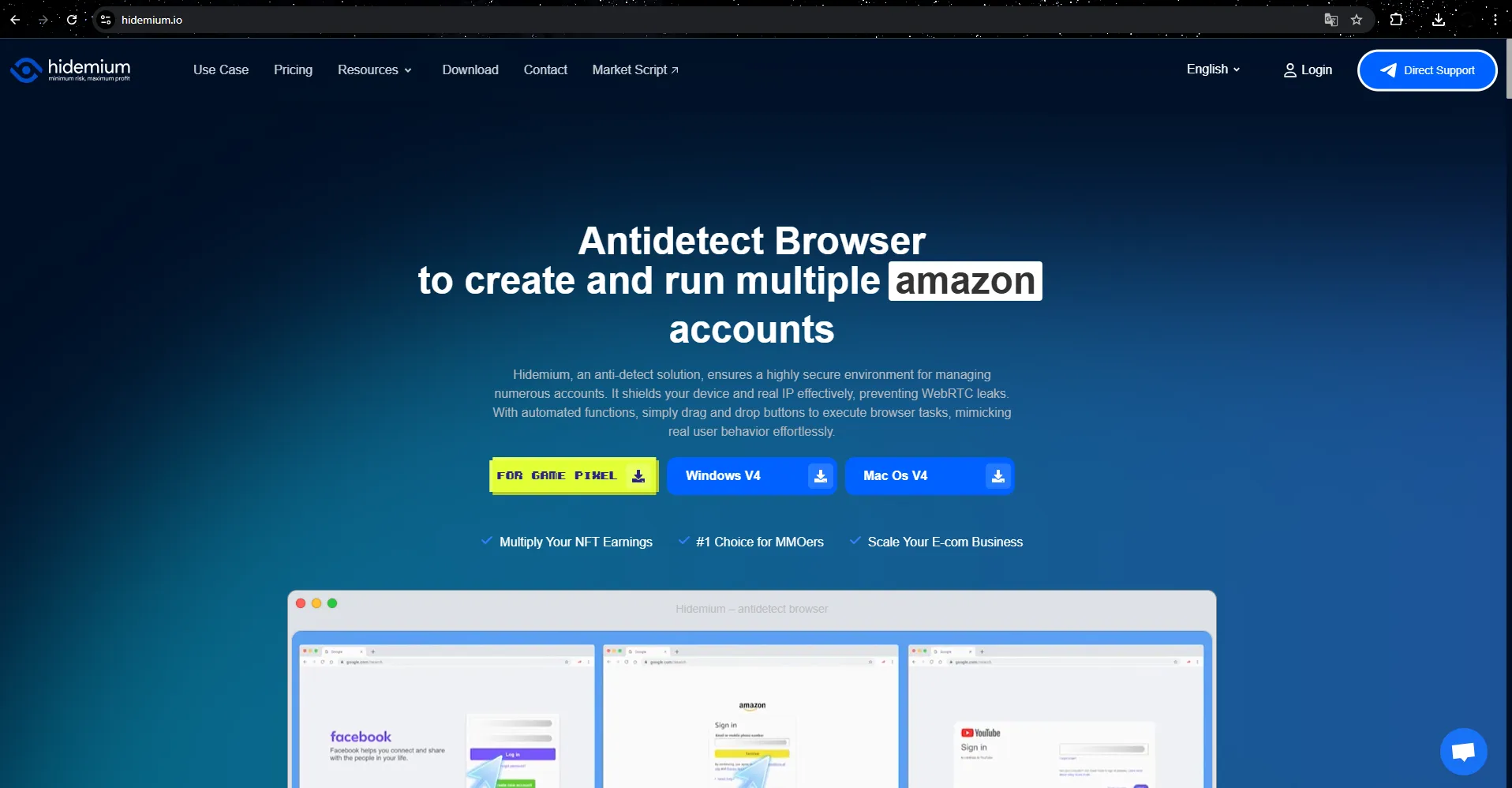

5. Manage multiple payment accounts more securely and efficiently with Hidemium

If you are using multiple accounts on platforms like Wise, PayPal or Stripe, it is extremely important to ensure that each account is separate and completely secure. Logging into multiple accounts in the same browser or sharing the same IP address can lead to issues such as identity verification requests, unusual activity alerts or even restricted access.

Hidemium antidetect browser– provides a comprehensive solution to this problem. Each profile in Hidemium is set up as a standalone browser, with fingerprints, login cookies and separate proxies, allowing you to operate multiple accounts without being detected or linked to each other by the system.

This tool is especially suitable for freelancer, affiliate marketer, remote worker, or anyone who is doing business globally and needs to manage multiple payment systems simultaneously. Whether you are switching from Payoneer to another platform, or want to test out multiple alternatives at once, Hidemium helps you maintain stability, security, and better control in every login session.

5. Conclusion

If you regularly conduct international transactions, then finding the Payoneer Alternatives is a wise move. Depending on the goal – reduce costs, fast money transfer, or increase business efficiency– Choosing the right payment platform will make a significant difference in the user experience.

In case you need to manage multiple accounts on different services, integrating the payment platform with the antidetect browser Hidemium s the ideal solution. Hidemium helps create a separate login environment for each account, limiting conflicts and ensuring safety when switching between platforms.

Although the conversion process is not too complicated, it brings many practical benefits: effective cash flow control, smoother workflow and Optimize your financial management experience comprehensively

6. Frequently Asked Questions (FAQ)

1. Which platform is better than Payoneer?

Wise. Highly regarded for its low transaction fees and transparent rates.AirwallexMore suitable for businesses that are in the expansion phase.

2. Should I choose Stripe or Payoneer?

Stripe is the optimal choice for e-commerce businesses and technical teams. Meanwhile,Payoneermore suitable for freelancers or those who regularly receive international payments.

3. Payoneer or Wise is the best choice?

Wise is transparent about fees and using real market rates, great for individuals who want direct control over the money transfer process.

4. Is Payoneer or Skrill more reliable?

Payoneer more reliable when used for business purposes. Meanwhile,Skrill has the advantage of fast transactions but fees are usually higher.

5. Between Payoneer and PayPal, which platform should I use?

PayPal has higher global coverage, howeverPayoneeroften have lower withdrawal fees, especially suitable for business payments.

6. Is Revolut the same as Payoneer?

Not exactly the same.Revolut acts as a digital bank, and Payoneer Focus on supporting payment receipt from international partners.

7. Why does Wise cost less than PayPal?

Wise uses real market rates and charges only a small fixed fee, while PayPal often plus the exchange rate difference makes it difficult for users to recognize.

8. What are the limitations of using Payoneer?

Some disadvantages of Payoneer. These include: higher service fees, long transfer times, and a less extensive country support coverage than alternative platforms like Wise or Revolut.

Related Blogs

Facebook has become a popular tool for companies, businesses, and brands to run ads effectively. However, many people run Facebook ads when the account is suddenly locked but do not know the cause. Let’s learn more about the problem of the locked ad account and the best solution through the following article! The ad account […]

If you're looking to enhance your online privacy or manage multiple social media, e-commerce, or ad accounts, Antidetect browsers are a crucial tool. With a wide range of options available, picking the right one can be a daunting task. To help you navigate, we've researched and compiled a list of the best Antidetect browsers for 2024. 1. What Are Antidetect Browsers?An Antidetect Browser is a[…]

"Buy social accounts" is gradually becoming a familiar trend for those who do marketing and brand development on digital platforms. If in the past this method was still met with many doubts, now it is considered an effective solution to shorten the time to build social media channels and optimize user access costs.Instead of spending months developing an account from scratch, businesses can quick[…]

How to Use Proxy302’s Proxies with Hidemium Try Proxy302 For Freewith the link:https://share.proxy302.com/hidemiumClick 【Start free trial】 and enter your personal information. Click【Register account】, the account is created successfully. If you have an account, just【Log in】.Why Use Hidemium?Hidemium is a modern antidetect browser trusted by professionals across the globe. It offers strong[…]

In the digital age, most of our devices are constantly connected to networks like Wi-Fi or mobile data. Each connection is identified by a MAC (Media Access Control) address. While you don’t need to change your MAC address often, it can affect your privacy and security online.Thanks to the development of technology, methods of protecting digital identity are also increasingly diverse and[…]

Having trouble verifying your LinkedIn account? This is a common issue that many users face, stemming from email verification errors, security concerns, or IP addresses being flagged by the system. In this article, Hidemium will help you understand the common reasons why verification fails, and provide specific troubleshooting instructions so you can easily regain access to your account.1. Why[…]

.png)

.png)