You are looking for Stripe alternatives? Is Stripe a reliable payment processing platform for your business? While Stripe is considered a powerful payment processing platform with many outstanding features, it is not always suitable for every business model. High costs, limited scope, and complicated setup process cause many store owners to consider looking for alternative payment solutions.

In this article, Hidemium Antidetect Browser will analyze and compare the Stripe competitor Top, pointing out the pros and cons of each platform to help you choose the most suitable option for your business.

1. Why consider Stripe alternatives?

Stripe is one of the most popular payment processors today thanks to its flexibility, stability, and developer-friendly API. However, there are still many reasons why companies look forStripe alternatives:

High transaction fees: Stripe charges a flat fee plus a percentage of each transaction. For low-margin businesses, especially low-cost e-commerce stores or subscription services, this fee can quickly become a burden.

Limited scope of operations: Stripe is not yet supported at all over the country, causing many businesses in outlying areas to seekOther payment solutions.

Inconsistent customer support: Many users report that Stripe is slow to respond, making it difficult for small businesses to get urgent support.

Complicated for beginners: Stripe is designed with developers in mind. This gives it the advantage of customization, but also makes it difficult for non-technical store owners or teams.

Therefore, the examinationon Stripe Competitorsis necessaryIt is essential to find a payment tool that is both cost-effective and simple to implement, while also meeting your business needs.

>>> Learn more: What is a Stripe account? How to create and use Stripe

2. Important Features When Choosing a Stripe Alternative

Not everyone payment gateways are the same. So, before deciding to use one Stripe Alternatives, businesses need to carefully consider the following key features:

Transparency about costs

Cost is the first factor to consider. Some providers apply fixed transaction fees, while others use a tiered fee model. Understanding your cost structure will help businesses accurately predict profits and optimize cash flow.

Global support capabilities

If you are doing international business, prioritize your choice Multi-currency payment solution and multiple local methods. This helps global customers have a smooth shopping experience and increases conversion rates.

Various payment methods

Consumers today expect more than credit cards. Digital wallets like Apple Pay, Google Pay, PayPal good direct bank transfer in some markets are becoming more popular. Supporting a variety of payment methods will help businesses reach more customers.

Support recurring billing for SaaS and subscription models

For SaaS businesses or services based on registration, recurring payments are a required feature. Tools likeFlexible payment cycle, automatic invoice, retry logic when transaction fails will guarantee steady revenue without manual monitoring.

Security and fraud prevention

Payment Security is an indispensable factor. A reputable payment gateway needs to haveAdvanced anti-fraud technology, fake refund prevention mechanismand comply with standardsPCI DSS, helping to protect both businesses and individuals.both business and customer.

Flexible integration capabilities

Modern businesses often require Powerful API to develop custom solutions or integrate directly with popular e-commerce platforms like Shopify, WooCommerce. Fast and easy deployment will save time and engineering costs.

>>> Learn more: Review of the best WooCommerce payment plugins today

3. Top Stripe Alternatives

Before exploring the Stripe Alternatives, it is important that businesses clearly identify the need for a Flexible, secure and easy to deploy payment gateway. Whatever your startup is startinggoodThe business has grown, choosing the right payment platform will directly affect revenue and customer experience.

3.1. PayPal

PayPal is one of the most reputable online payment services, trusted by millions of businesses and individuals worldwide. PayPal's great advantage lies in Strong branding, quick setup process and global support, making it an ideal choice for e-commerce and freelancer. Of Users also appreciate theDiversity in payment methodsalong withfamiliar experiencewhen used.However, the downside of PayPal is that transaction fees are higher than average and the refund process is not really stable.

>>> Learn more: How to Create Multiple PayPal Accounts for Beginners

3.2. 2Checkout (Verifone)

Formerly known as 2Checkout, Verifone is now one of the Stripe alternatives worth considering for global e-commerce businesses. The platform supports barbarian-multi-currency, recurring payment, and also provide fraud prevention effectively. As a result, Verifone becomes a powerful solution for bothSaaS business and online retailers looking for opportunities to expand into international markets. However, one notable limitation is that higher feesCompared to many local suppliers, this can affect the profits of businesses with high trading volumes.

3.3. Braintree

Developed under the ownership of PayPal, Braintree provides an optimal payment solution for SaaS companies, mobile apps and e-commerce platforms. Braintree's strengths areRecurring payment support, international scalability together with Advanced fraud detection tools. This is an effective option for subscription models, but the platform requires in-depth technical knowledge during implementation, it may cause difficulties for small businesses or teams with limited development resources.

3.4. Adyen

Adyendesigned specifically for large businesses with high trading volumeand is currently used by many global brands such asUber, Spotify, Microsofttrust. Adyen stands out withUnified Payment Platform, allowing transaction processingonline, in-store and mobile smoothly. In addition, the system also providesDetailed analytics reporting, multi-channel support, and advanced anti-fraud security. However, due to complex fee structure and oriented to serve large enterprises, Adyen is not really suitable for small shops or startups.

3.5. FastSpring

Similar to Paddle, FastSpring also operates under the MoR model, focusing on supporting SaaS companies and digital product providers. FastSpring's strength lies in its management capabilities.global payment, processing recurring subscription transactions and compliance. This is the right choice for software startups to rapidly expand internationally. However, specializing in only digital products caused FastSpring Not really ideal for businesses that deal in physical goods.

3.6. Shopify Payments

Shopify Payments is a payment solution that is integrated directly into the Shopify system, providing superior optimization for online store owners. Eliminating the intermediary makes the payment process seamless, fast and brings a convenient shopping experience to customers. The limitation of Shopify Payments is that it is only available on the Shopify platform, so it is not suitable for businesses using other e-commerce platforms.

3.7. Paddle

Unlike conventional payment gateways, Paddle operates on a Merchant of Record (MoR) model. That means Paddle handles taxes, invoicing, and refund management on behalf of the business. Thanks to that, companies – especiallySaaS business and software companies– can significantly reduce the administrative burden, while ensuring compliance with VAT, GST regulations. However, in return,Paddle usage costs are usually highercompared to traditional payment providers.

3.8. Authorize.net

Authorize.net is one of the oldest online payment gateways, still trusted by many small and medium-sized businesses. The service stands out for its stable credit card processing, high security, and wide range of applications in many business areas. However, some users have commented that Authorize.net's management interface and dashboard are somewhat outdated compared to more modern payment platforms.

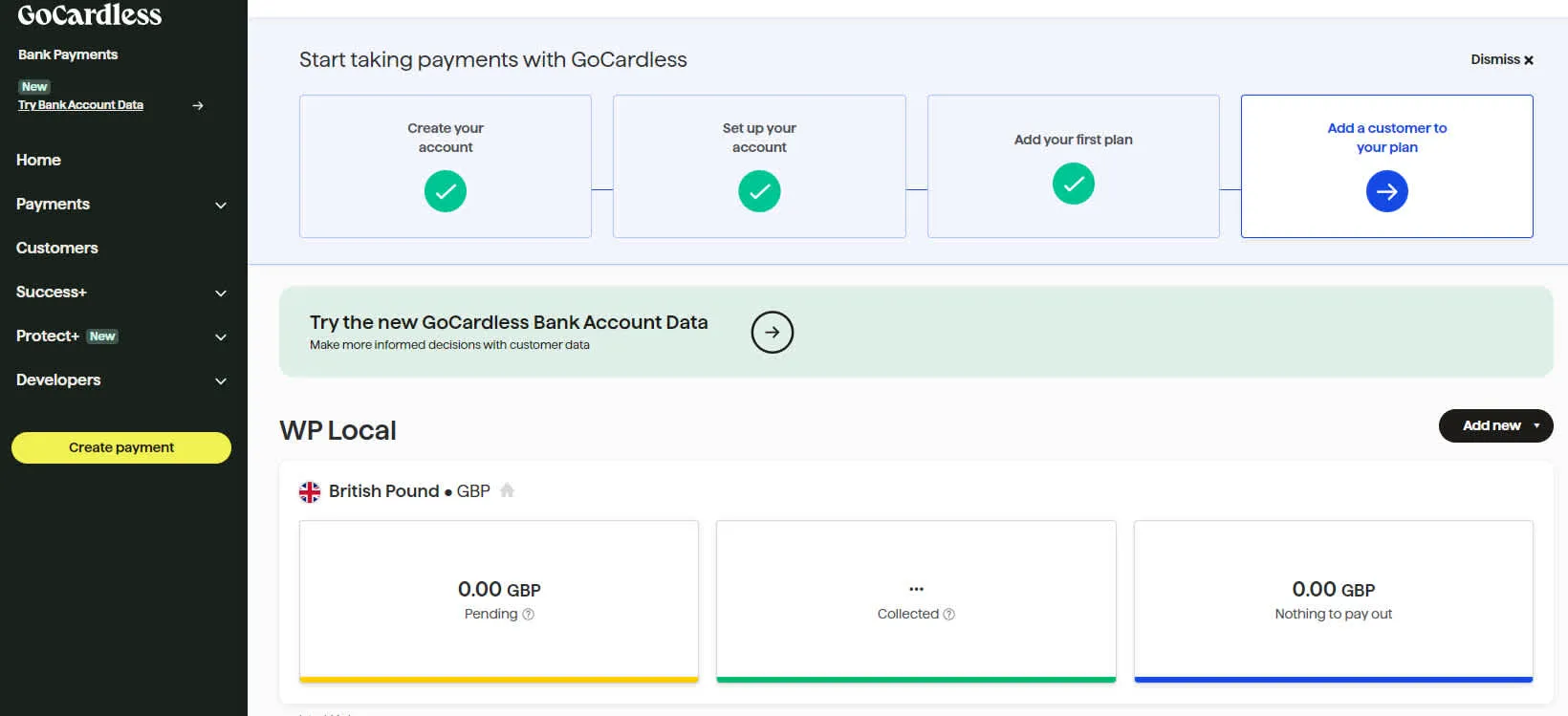

3.9. GoCardless

GoCardless focuses on processing recurring payments and direct transfers, making it a great fit for subscription, membership, or recurring billing business models. The platform’s competitive fees and secure, reliable transfer system make it a standout. However, GoCardless is limited in supporting one-time transactions, which can impact the flexibility of businesses that need multiple payment methods.

3.10. Square

Originally introduced as a POS (Point of Sale) system, Square now become one Comprehensive payment gateway. This platform is widely used.small business and retail stores trusted thanks to its simple setup process, integrated POS hardware built-in and transparent fees. However, Square is still limited in terms of international assistance, this can become a barrier for businesses that want to expand into the global market.

>>> Learn more: Close PayPal Account and Create New Account Without Getting Banned

4. Comparison table of the best Stripe alternatives

To find out Stripe alternatives to be suitable, you need to compare payment platforms based on important factors such as service fees, integration capabilities and security. The table below will help you get an overview, from which you can easily choose the solution that meets your business needs.

Supplier | Suitable for | Advantage | Limit |

| PayPal | E-commerce, Freelancer | Global reach, prestigious brand | High fees, easy to get refunded |

| Braintree | SaaS, marketplace | Recurring payments, anti-fraud technology | Requires complex technical installation |

| Adyen | Large scale enterprise | Multi-channel support, in-depth data analysis | Complex pricing structure |

| Square | Small Business | POS and online payment integration | Restrictions on international scope of operations |

| Paddle | SaaS, software | MoR model, supporting legal compliance | High transaction fees |

| FastSpring | SaaS, digital products | Automatic tax processing and registration management tool | Less suitable for retail model |

| 2Checkout (Verifone) | International Sales | Multi-currency, multi-payment methods | Fees may vary |

| Authorize.net | Small and medium enterprises | Safe and secure payment gateway | Old interface, less friendly |

| Shopify Payments | Shopify Store Owner | Direct integration, easy to use | Exclusive to Shopify |

| GoCardless | Subscription and recurring payment services | Low fees, direct transfer support | Restrictions on one-time payments |

👉 With the comparison table above, you can quickly identify the strengths and weaknesses of each Stripe Alternatives, thereby making the best choice for your business.

5. How to choose the right Stripe alternative

When searching Stripe Alternatives, businesses need to consider carefully based on business model, target audience and budget. Each type will be suitable for different suppliers:

Solutions for SaaS companies

If you operate a SaaS model, platforms likePaddle, FastSpring hoặc Braintree are the ideal choice. These solutions stand out withPowerful recurring billing features, while supporting businesses to manage legal compliance safely and effectively.

Solutions for small businesses

For small businesses, simplicity and ease of implementation are top priorities. Platforms likeSquare, PayPal hoặc Helcimallows for quick setup, no technical expertise required, helping small teamsStart getting paid in just a few steps.

Solutions for global businesses

Companies with international scale will benefit from big names likeAdyen and 2Checkout. These platforms provide a global payment network, support Multi-currency, multiple payment methods and advanced analytics tools. This is the right choice for businesses with large trading volume and need to expand international markets.

Solutions for e-commerce

In the field of e-commerce,Shopify Paymentsoffers seamless integration for Shopify stores. In addition,PayPalremains a popular and trusted choice, helping to build trust with customers and increase conversion rates.

Solution for subscription service

For businesses specializing in providing registration services,GoCardless hoặc Braintreeare solutions worth considering. Both supportAutomate invoices, manage recurring payment cycles, and minimize the risk of failed payments, ensuring stable cash flow.

By analyzing the actual needs of your business and comparing them with each of the above options, you can easily find out Stripe Alternatives bring the most optimal value to business operations.

6. Conclusion

Stripe is still considered one of the Top online payment gateway, but not the only option. Depending on the business model and size, businesses may find alternative solutions that offer lower costs, better customer support, or specific features that Stripe does not yet offer.

For example: PayPal and Square is a suitable choice for small businesses; Paddle and FastSpring designed optimally for SaaS companies; while Adyen become a trusted solution for large corporations. Each platform has its own advantages and disadvantages. Therefore, businesses need to carefully assess their needs, test them and compare actual costs to choose the optimal solution.

It is important that you do not rely on a single solution. Choosing Stripe alternative payment gateway. Appropriate will help bring flexibility to customers, reduce the risk of payment interruption and create the premise for sustainable business development.

7. FAQ – Frequently Asked Questions about Stripe Alternatives

1. What is the best alternative to Stripe?

This depends on business needs:

SaaS: Paddle, FastSpring, Braintree

Small Business: Square, PayPal

Global Enterprises: Adyen, 2Checkout

Shopify: Shopify Payments

2. Is Stripe owned by Elon Musk?

No. Stripe is a privately held company run by founders Patrick and John Collison.

3. Is Adyen cheaper than Stripe?

Depending on transaction volume and region, Adyen is often more cost-effective for large businesses, while Stripe is more suitable for small and medium-sized businesses.

4. Is Zelle better than Stripe?

No. Zelle only supports person-to-person payments, while Stripe is specialized for e-commerce transactions and online payments.

5. Should I choose Stripe or Square?

Stripe is ideal for online businesses and subscription models, while Square is better suited for small stores and brick-and-mortar retail.

6. Does PayPal own Stripe?

No. Stripe is an independent company. PayPal only owns Braintree, which is not related to Stripe.

Related Blogs

Have you ever felt tired eyes from constantly staring at the tiny phone screen to text? If so, you are not alone. With nearly 3 billion WhatsApp users worldwide, many of us are also looking for a more convenient solution.The good news is: WhatsApp Web is the perfect choice to help you get rid of that inconvenience. Now, you can chat on a large screen, type faster with a computer keyboard, and[…]

In the digital age, as internet usage becomes more widespread, so do threats from viruses and hackers stealing data. That’s why proxy servers have become essential tools, helping users safeguard their personal information and access the web more securely.This article by Hidemium introduces you to the 15 best free proxy websites available today—tools that help you browse efficiently, securely, and[…]

LinkedIn Premium offers a variety of plans to suit every professional's needs. In this article, you'll learn how to get LinkedIn Premium for free completely, along with a list of outstanding offers in 2025.Whether you're looking for a job, generating leads, growing your business, or recruiting top talent, LinkedIn Premium is the tool to help. Plus, Hidemiumalso share one New alternatives in 2025,[…]

Managing multiple TikTok accounts can be a challenge, especially if you don’t want your content to be flagged or banned. If you're running multiple accounts on a single device, TikTok might mistake you for a business and stop displaying your content on the "For You" page. This means fewer views and engagement, which can seriously impact your reach, especially considering that 30% of global[…]

TikTok Shop is becoming one of the most potential sales channels for MMOers. However, one of the most annoying errors that users often encounter is the situation Cart is locked, buy button not showing. In this article, we will analyze the causes leading to this situation TikTok Shop Cart Locked, how to fix it, and how to use the Hidemium app to keep your TikTok Shop profile safe and secure, no[…]

Are you tired of managing multiple social media accounts daily? What you want is a comprehensive solution for managing social media accounts. Although it requires a lot of effort, having multiple accounts on online platforms is essential and beneficial for businesses. The article will tell you the secret to managing social media accounts effectively, so […]

(1).png)