If you are starting an online business, providing services, or working as a freelancer, setting up a payment system is indispensable. Among the platforms that support receiving international payments, Stripe is a prominent name trusted by many individuals and businesses. So What is a Stripe account?, how it works and how to use it, let's find out together Hidemium Antidetect Browser learn about.

1. What is a Stripe account?

Stripe is an online payment platform that helps individuals and businesses receive payments from customers over the Internet. Unlike traditional bank accounts, Stripe acts as an intermediary payment gateway, connecting your website, app or online store with popular payment methods such as credit cards, e-wallets or bank transfers.

When a customer pays, Stripe processes the transaction and displays the details in your dashboard, where you can track your money, issue refunds if needed, and set up transfers to your bank account. Stripe handles all the technical aspects, so you don’t have to build your own payment system.

1.1. Who should use Stripe and practical applications

Stripe is suitable for many audiences:

Freelancer Working with international clients can send invoices with quick payment links.

Online shop owner Easily integrate Stripe into platforms like Shopify or WooCommerce for direct payments on your website.

Non-profit organization You can create a Stripe account to receive donations transparently and securely.

1.2. Why choose Stripe?

You can think of Stripe as a Global Digital Payments Center:

Receive money from all over the world

Flexible integration with multiple platforms

Highly secure and easy to use

Support effective cash flow management

With these advantages, Stripe is not only a payment tool but also a solution to help you expand your online business in a systematic and professional way.

>>> Learn more: How to Create Multiple PayPal Accounts for Beginners

2. How to create and start using a Stripe account effectively

Setting up a Stripe account to receive online payments is not complicated at all. Even if you are a newbie, just follow the instructions below and you will quickly have a smooth-running Stripe account.

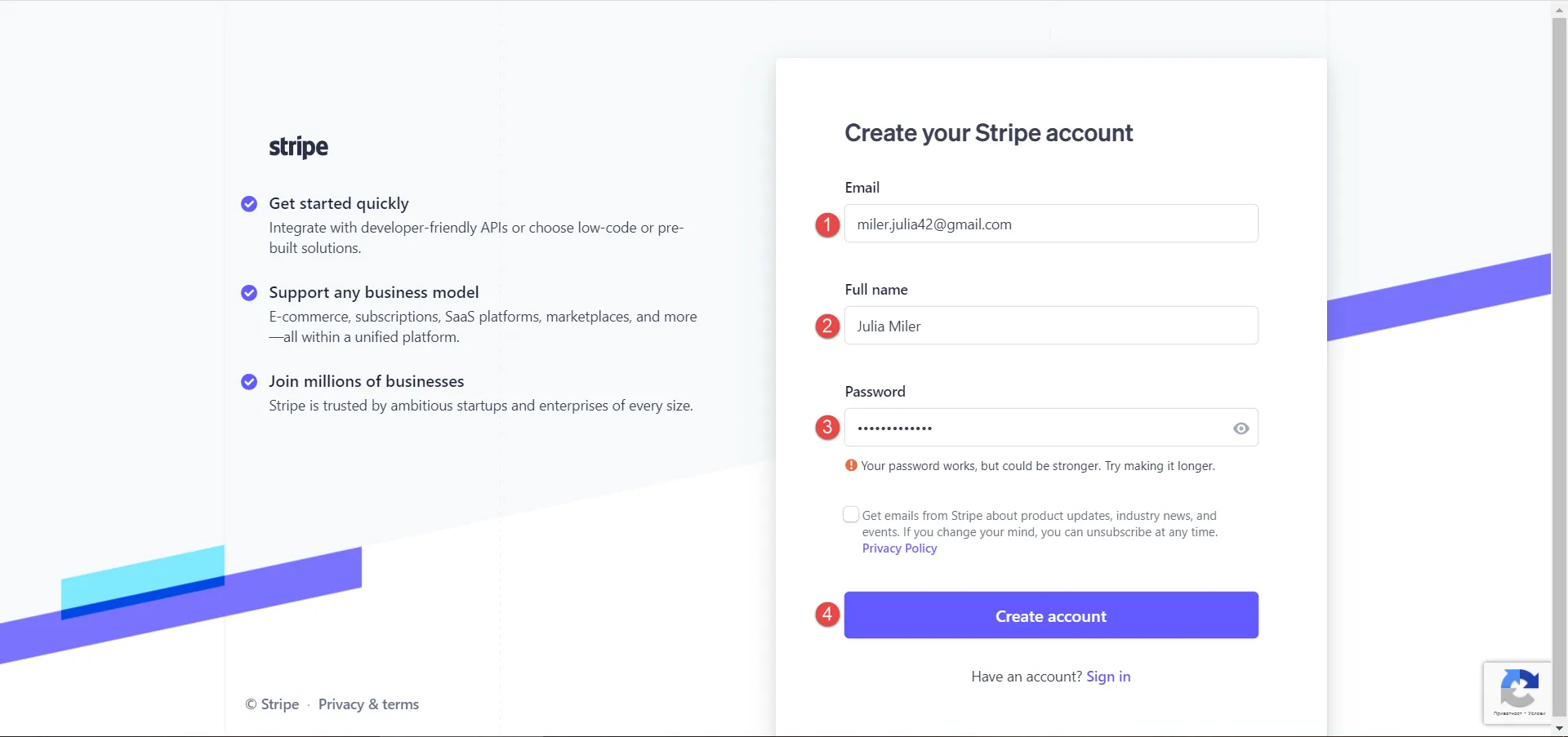

Step 1: Sign up for a Stripe account

Go to Stripe’s official website and click “Get Started” or “Sign Up”. Fill in all the information such as email, full name, password and country of residence. Then, confirm your email to complete the account creation step.

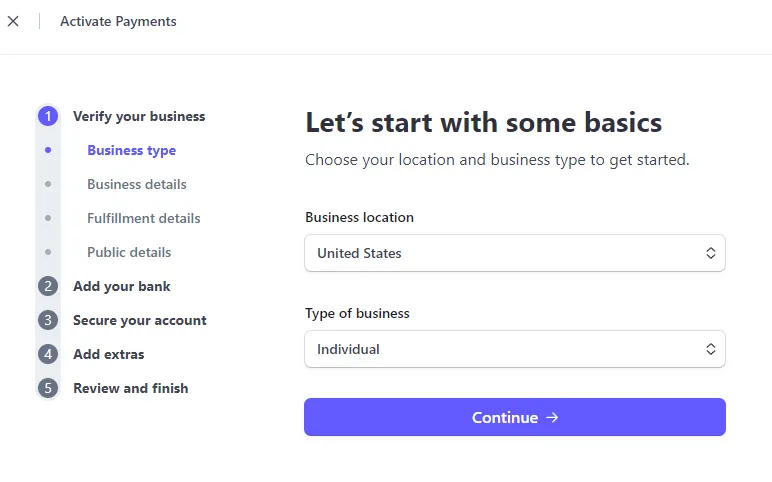

Step 2: Enter business or personal information

Stripe asks you to provide some basic information about your business, including your business name, type of product/service, and estimated monthly revenue. If you're a freelancer or an individual who doesn't have a registered business, you can still use your personal name and a specific description of what you do.

Step 3: Connect your bank account to receive money

To receive payments, you need to link a bank account that matches your currency. This account should be in your or your business's name. Stripe will periodically transfer funds to this account according to the payment schedule you set up.

Step 4: Verify personal or legal identity

For security and compliance purposes, Stripe requires identity verification. You may need to provide a photo of identification such as a government ID, passport, utility bill, or business license. Verification typically takes just a few hours to complete.

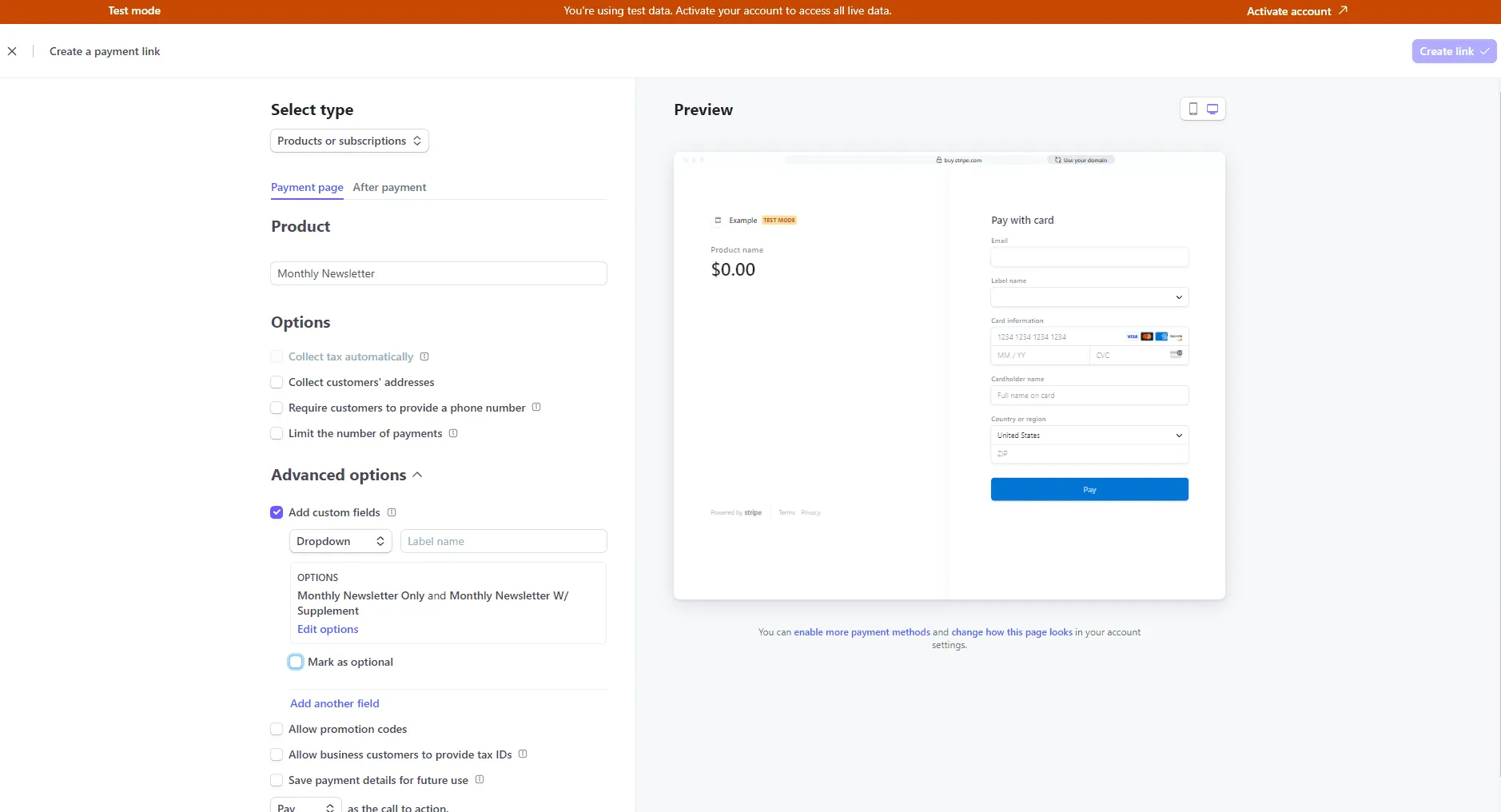

Step 5: Run a test with Stripe's test mode

Stripe offers a test mode that allows you to simulate transactions using test cards. This feature is useful if you are integrating Stripe into your website, allowing you to test the entire payment process before going live.

Step 6: Activate your account and start receiving payments

Once you’ve completed verification, you can move your account to live mode. From here, your Stripe dashboard will display all your transactions, and funds will be automatically transferred to your linked bank account. You’re now ready to accept payments online easily and securely.

3. Stripe Fee Schedule: Details on how transaction fees are calculated

Stripe offers a transparent “pay per transaction” pricing model, meaning you only pay when you actually receive a payment. There are no setup fees, no monthly fees, and absolutely no hidden costs – ideal for individuals or small businesses who don’t want a long-term commitment.

3.1. Online transaction fee via card

For online credit or debit card payments, Stripe charges 2.9% of the total transaction value, plus $0.30 per payment. This fee applies to major cards such as Visa, Mastercard, American Express, and Discover. Stripe automatically deducts this fee before transferring the remaining amount to your bank account.

3.2. Fees for direct payment via Stripe Terminal

When you use Stripe’s physical card reader – also known as a Stripe Terminal – to accept payments directly, you will enjoy more favorable fees. Specifically, in the US, Stripe applies a fee of 2.7% for each transaction, plus $0.05. This is a suitable solution for retail stores or businesses that operate both online and offline.

3.3. Bank transfer fee (ACH)

Stripe supports payments via ACH bank transfers – the optimal choice for large or recurring transactions. For each ACH debit payment, Stripe charges a fee of 0.8%, but not exceeding $5. Compared to card payments, this method offers significant cost savings for large transactions.

3.4. International transaction fees and currency conversion

If you receive payments from international customers or in other currencies, Stripe will apply two additional fees: 1% for international cards and 1% for currency conversion. This brings the total fee for a cross-border transaction to 4.9% + $0.30.

3.5. No monthly fees or additional costs

A big plus with Stripe is that there are no monthly maintenance fees and no minimum balances required. All payment management tools are available within the Stripe dashboard, allowing you to track, export reports, and control transactions easily. Stripe only charges you when you actually process payments.

>>> Learn more: Close PayPal Account and Create New Account Without Getting Banned

4. Outstanding features of Stripe – Comprehensive payment solution for all business models

Stripe is not only an online payment platform but also integrates many superior features, meeting the diverse needs of businesses of all sizes. Below are the highlights that make Stripe the top choice in the field of electronic payments:

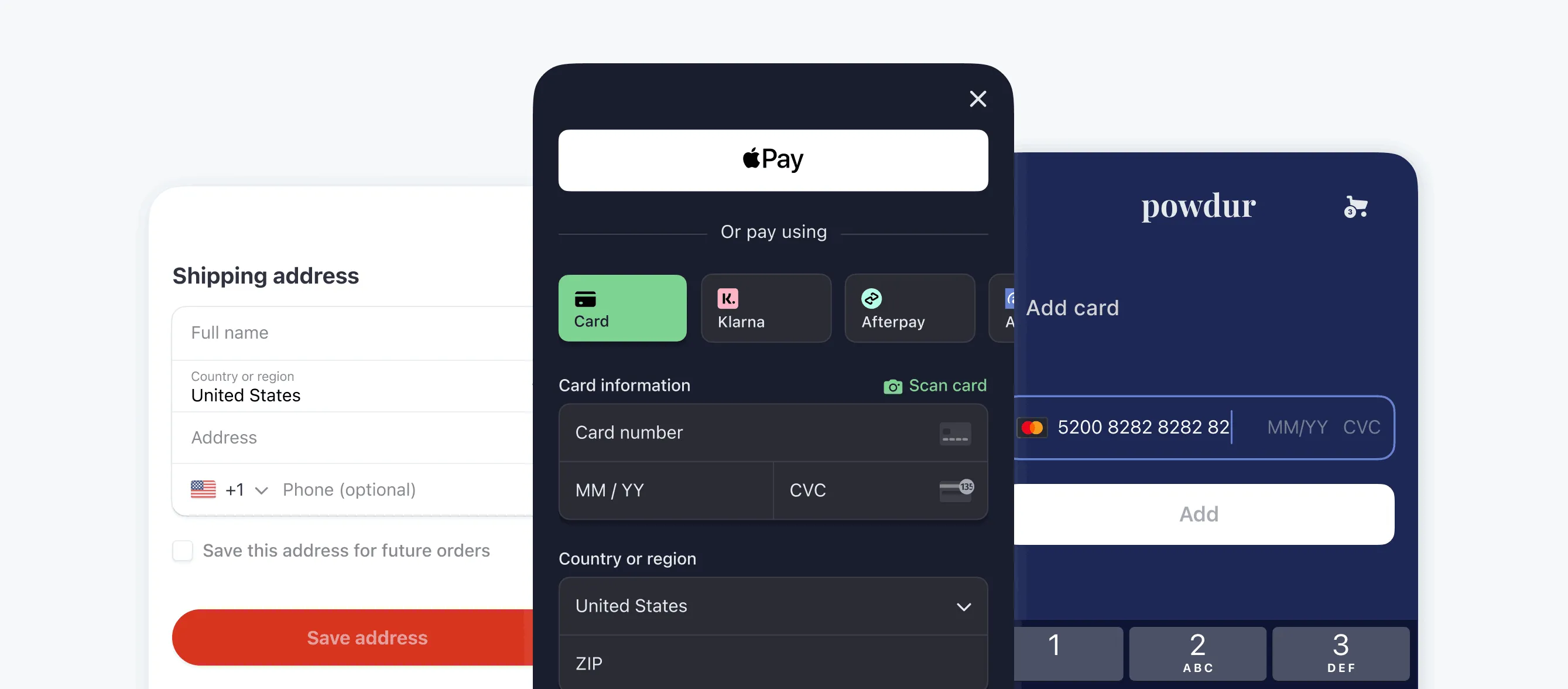

Accept a variety of payment methods: Stripe allows users to pay with credit cards, debit cards, e-wallets like Apple Pay, Google Pay, as well as bank transfers (ACH, SEPA), providing maximum flexibility for both sellers and customers.

Handles over 135 currencies: With the ability to support transactions in multiple currencies, Stripe makes it easy for businesses to internationalize their operations. The system also automatically converts currencies to your desired units, helping to simplify accounting and financial management.

Anti-fraud with artificial intelligence: Stripe Radar uses AI to detect and block unusual or potentially risky transactions, helping to effectively protect your account from fraudulent activity.

Flexible payment schedule options: Stripe allows you to set up your payout cycle to be daily, weekly, or monthly – depending on your business's financial needs and operating market.

Optimized for programmers: With a powerful API system and detailed documentation, Stripe helps developers build and customize payment processes easily, suitable for all technical specifications.

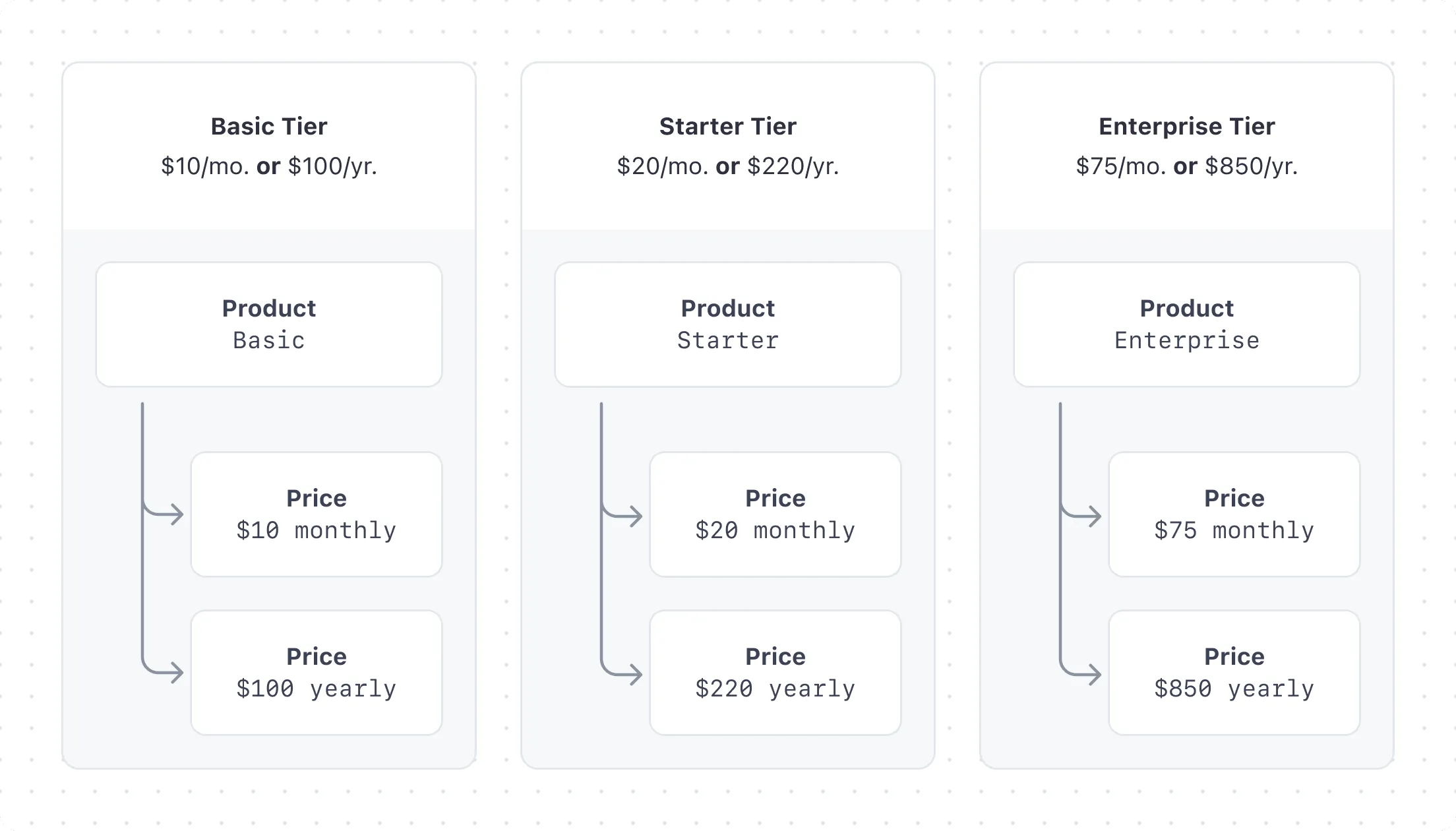

Extensive toolkit for growing businesses:

Stripe Connect: Supports payment processing between multiple parties on the platform.

Stripe Billing: Manage recurring payments and subscriptions.

Stripe Terminal: Support payment at point of sale via terminal.

Stripe Issuing: Issue custom virtual or physical payment cards.

Stripe Atlas: Support for company establishment, opening bank accounts and setting up tax systems for global businesses.

With comprehensive and flexible features, Stripe is an ideal choice for both startups and growing companies. The platform offers a modern, secure payment processing solution that integrates easily into any business process.

>>> Learn more: How YouTube Pays: Understanding Earnings Per View

5. Stripe, PayPal or Square – Which Payment Gateway is Best for You?

Among the popular payment platforms today, Stripe, PayPal and Square are the top three choices, each with its own strengths suitable for each business model. Choosing the right payment gateway not only helps optimize operational efficiency but also enhances customer experience.

Below is a detailed comparison table to help you easily evaluate and choose:

Criteria | Stripe | PayPal | Square |

| Best suited for | Online business, recurring payment model, global operations | Individual, small shop, retailer | Direct stores, local businesses |

| Customization capabilities | High level – powerful API support, suitable for developers | Restrictions – PayPal branded interface | Average – easy to install and use |

| Supported payment methods | Variety: credit cards, e-wallets, ACH, supports over 135 currencies | Cards, PayPal wallet, account balance, some local methods | Cards, e-wallets, simple bills |

| Money transfer time | Flexible by day, week or month | Fast – from minutes to 1–3 business days | Average – usually within 1–2 days |

| International support capabilities | Very powerful, has automatic currency conversion | Good in many countries but still has region restrictions | Limited, only supports some markets |

| POS payment device | Stripe Terminal included (optional) | Limited hardware | Full POS system |

| Standard Fee Schedule | 2.9% + $0.30 per online transaction | 2.9% + $0.30 per regular transaction | 2.6% + $0.10 for on-site payments, 2.9% + $0.30 for online payments |

| Ease of use | Medium – easier to integrate with Shopify, WooCommerce… | Very easy – personalised | Fast setup, optimized for physical stores |

Which platform should I choose?

If you need a payment solution flexible, possibly global expansion and easy custom, Stripe is a worthy investment.

PayPal is a simple and convenient solution, suitable for those who want/get money fast without complicated setup.

Meanwhile, Square especially suitable for local business or retail stores, thanks to the complete and easy-to-use POS system.

6. Advantages and disadvantages of using a Stripe account

Stripe is one of the most popular online payment platforms due to its flexibility and scalability. However, like any tool, Stripe is not a perfect fit for every business. Here is an overview of Stripe's strengths and limitations so you can consider which option is right for your needs.

6.1. Advantages of using Stripe

Stripe is trusted by many businesses thanks to its harmonious combination of friendly interface and advanced features. Some highlights include:

Simple yet powerful: Stripe allows for quick setup without requiring in-depth programming knowledge. However, if you want more complex customization, the platform still provides full support tools.

Clear costs, no hidden fees: Stripe applies a transparent charging policy with fixed fees, helping businesses easily control spending and manage budgets effectively.

Global payment support: Stripe allows you to receive payments in over 135 different currencies and supports automatic foreign currency conversion, expanding your access to international markets right from the start.

Suitable for growing businesses: Whether you're a startup or an enterprise processing thousands of transactions per month, Stripe's infrastructure is robust enough to handle it without complex changes.

If you're looking for a payment solution that's highly flexible, has global reach, and is easy to scale as your business grows, Stripe is a great option to consider.

6.2. Disadvantages of using Stripe

Despite its many outstanding advantages, Stripe still has some limitations that can affect the decision to use it:

Technical requirements for advanced customization: The basic setup is pretty easy, but if you need to build a custom checkout process or integrate a separate subscription system, you may need help from a developer.

Some sensitive areas are not supported: Stripe limits its service to industries that are considered high-risk, such as gambling, adult content, or dietary supplements. This can be inconvenient if your business operates in these areas.

First transfer delayed: For new accounts, Stripe may hold your first payment for 7 to 14 days. This can be a problem if you need quick cash flow to operate.

The above limitations are important factors to consider, especially when your business operates in a specific field or needs to continuously rotate capital.

>>> Learn more: How Does TikTok Pay? Earnings Calculation and Smart Money Making Tips

7. Manage Multiple Stripe Accounts Securely with Hidemium

If you run multiple businesses, work with different brands, or experiment with e-commerce projects simultaneously, having and operating multiple Stripe accounts is inevitable. While Stripe does support users to create multiple accounts in certain cases, logging into these accounts on the same device or browser is easily detected by the system, leading to restricted access or even account lockout.

At this time, one antidetect browser like Hidemium is the ultimate solution for securely managing multiple Stripe accounts. Hidemium allows you to create multiple browser profiles, each with its own fingerprint, cookies, and proxy. These profiles act as independent virtual devices, making it easy to log into different accounts without fear of being detected or linked.

Hidemium's outstanding features support effective Stripe management:

Unique Fingerprint for each profile: Each created profile will have separate information such as user-agent, time zone, font, resolution,... to help simulate the browser environment like a real device, completely separate.

Flexible proxy integration: Hidemium allows assigning different IP addresses to each profile, avoiding duplicate IPs and helping to overcome geographical restrictions.

Separate cookies and login sessions: Browser data is isolated between profiles, making each login a clean session, minimizing the risk of linking accounts.

Support for teamwork: You can share specific profiles with colleagues without revealing the original account information, increasing security when working in groups.

Cross-platform sync: Profiles can be synced across multiple devices, giving you the flexibility to manage your account anytime, anywhere.

For those running multiple Stripe accounts, Hidemium not only helps you separate your browsing identity, but also enhances privacy and gives you complete control. Thanks to that, you can rest assured to develop your business without worrying about your account being locked or encountering troublesome verification issues.

8. Conclusion

Account Stripe What is Stripe? Stripe is a flexible and reliable online payments solution that makes it easy to get paid, manage transactions, and grow your business over time. From individual content creators to large-scale platforms, Stripe caters to a wide range of needs with its transparent pricing model and powerful technical toolset.

If you are running multiple brands or projects at once, using an antidetect browser like Hidemium is a smart choice to separate and protect each Stripe account, minimizing the risk of being locked or flagged for violations.

When set up properly and combined with the right security tools, Stripe is more than just a payments platform, it's a solid foundation for you to build and scale your business safely and efficiently.

9. FAQ – Frequently Asked Questions

1. What is a Stripe account used for?

Stripe helps you accept payments online via credit cards, e-wallets, or bank transfers. You can easily manage transactions, track transfers, and process refunds – all from a single dashboard.

2. Is Stripe like PayPal?

No. Both Stripe and PayPal support online payments, but Stripe is designed for businesses that need more customization and control over their payment processes, while PayPal is better suited for personal money transfers and simple needs.

3. Is there a fee to create a Stripe account?

No. Stripe is free to set up and maintain an account. You're only charged when a transaction is successful, there are no hidden costs or monthly fees.

4. Is a Stripe account a bank account?

No. Stripe is not a bank, it is a payment processing platform. The money you receive will be transferred by Stripe to your real bank account on a recurring payment schedule.

5. Can I keep funds in my Stripe account?

Yes, but only temporarily. Stripe will hold the funds until the next transfer. Stripe does not operate as a digital wallet or savings account, so it does not store funds long-term.

6. Is Stripe safe with bank accounts?

Yes. Stripe uses advanced data encryption, PCI compliance, and integrated anti-fraud tools to keep your accounts and customer information safe.

7. Why do many people choose Stripe over PayPal?

Stripe is popular for its customizable checkout process, advanced programming features, and efficient international transactions. Stripe is also ideal for recurring fee models or multi-user platforms.

8. What are the disadvantages of Stripe?

Stripe can be a bit complicated for people without a technical background. New accounts may also experience a delay in their first transfer. Additionally, Stripe does not support industries considered high-risk, such as gambling or adult content.

9. Who founded Stripe?

Stripe was founded by two Irish brothers – Patrick and John Collison. Currently, the company is a private enterprise with headquarters in San Francisco (USA) and Dublin (Ireland).

Related Blogs

In the digital age, online privacy and security are becoming increasingly important. Proxyium emerged as a leading solution, allowing users to easily change their IP address, browse the web anonymously and protect personal information from cyber threats. With the ability to access restricted content and effectively hide their identity, Proxyium is not only useful for individuals but also[…]

The problem of ad account deactivated Facebook is no longer a rare thing. Due to many reasons, your account “evaporated” from this social networking platform. So what causes the Facebook ad account to be disabled? Follow the article to get the most accurate answer. Reasons Ad account deactivated Facebook How would you feel if one […]

In 2025, making 100 dollars online per day has become more realistic than ever. The rapid development of digital platforms and new business models has created opportunities for anyone to build a stable source of income right at home. In this article, Hidemium will introduce 21 legal methods that help you increase your profits, along with helpful tips to maximize your earning potential.1.[…]

In the modern internet environment, security is always a top concern. One of the factors that plays an important role in protecting online data is Port 443 - the standard connection port of the HTTPS protocol. So specifically Port What is 443? and why is it so important? Let's go together Antidetect Browser Hidemium Learn how Port 443 works, functions and instructions for using Port 443[…]

As more and more users face difficulties with Payoneer — from high fees, payment limits to inaccessibility in some countries — the need to find solutions Payoneer Alternatives is increasing rapidly. Grasping that trend, many new international payment platforms have been born, providing more flexibility in cash flow management, optimizing costs and ensuring smooth cross-border[…]